← Back to Newsletter Archives

December 2020 – Volume 24 Issue 4

The Internal Revenue Service requires that 1099 forms be issued to unincorporated vendors (such as independent contractors and landlords) who have provided purchased services or goods of $600 or more during the calendar year, and to attorneys for fees or amounts paid for gross proceeds of $600 or more. Beginning with the 2020 tax year, use the 1099-NEC form to report nonemployee compensation of $600 or more to unincorporated vendors, and continue to use the 1099-MISC form to report payments for miscellaneous items, including rents, prizes and awards, medical and health care payments, and gross proceeds paid to an attorney.

Within the School Accounting System, both the 1099-NEC and 1099-MISC forms can be generated. To designate a vendor as a 1099 vendor in order to issue a 1099-NEC or 1099-MISC form at the end of the calendar year, complete the following fields on the Miscellaneous tab in the Vendor File:

- Federal ID Type field

- Federal ID field

- Federal Form Type field

- Federal Form Box ID field

- Additional Recipient Name field (and Print Location field), if needed

- Accumulate 1099 Amount field

Then during the end of calendar year process, the 1099-MISC and 1099-NEC forms can be generated and printed, and a 1099 file can be created to submit to the Internal Revenue Service if filing electronically. For detailed instructions on generating and printing the 1099-MISC and 1099-NEC forms in the School Accounting System, click here to request the Accounts Payable End of Calendar Year Checklist Webinar recording.

Newsletter Survey

On the topic of 1099s: How many 1099s do you typically issue in a calendar year? Will you be issuing both 1099-NEC forms and 1099-MISC forms this year, or just one form or the other?

On the topic of 1099s: How many 1099s do you typically issue in a calendar year? Will you be issuing both 1099-NEC forms and 1099-MISC forms this year, or just one form or the other?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

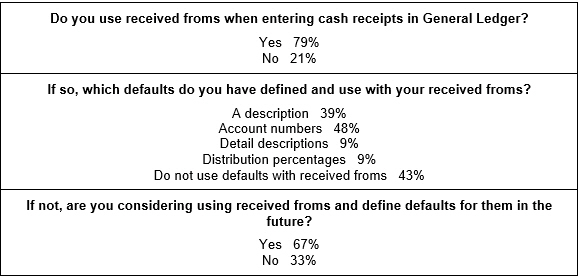

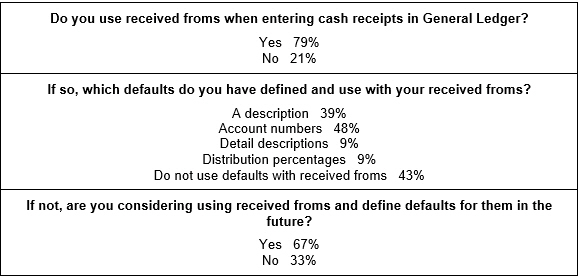

The Newsletter Survey questions for the September 2020 issue related to cash receipts. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

Reminders for End of Calendar Year

Once again, the year is winding down and it is time to start completing all the end of calendar year activities, including preparing and issuing 1099s, W2s, and 1095s. As you begin completing the end of calendar year tasks, below are a few tips and deadlines to keep in mind.

Tips:

- Follow the instructions on the Accounts Payable End of Calendar Year Checklist and Payroll End of Calendar Year Checklist to be sure all steps are completed.

- Nonemployee compensation payments of $600 or more to unincorporated vendors are now reported on the 1099-NEC form; continue to use the 1099-MISC form to report payments for miscellaneous items, including rents, prizes and awards, medical and health care payments, and gross proceeds paid to an attorney.

- If needed, to add a second name for a vendor to print on the 1099-NEC or 1099-MISC form, complete the Additional Recipient Name field in the Vendor File, and then complete the Print Location field to specify which line the additional name needs to print.

- Use the Adjust 1099 Amounts option to enter an adjustment for a 1099 amount for a vendor.

- Employers are required to report the amount of qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA) in Box 14 on the W2, or in a statement provided with the W2.

- For W2s, define the order items will post and print in Box 14 for employees by using the W2 Box 14 Default Order option. Reminder, only nine items will post to Box 14 for an employee, with only the first four of those posted items actually being printed on the W2.

- Allow time for your employees to review their W2s and 1095s before submitting the returns to the government.

Deadlines:

- Deliver 1099-NEC and 1099-MISC forms to vendors by January 31.

- Submit 1099-NEC forms to the Internal Revenue Service by January 31 if filing by paper or electronically via the Internet.

- Submit 1099-MISC forms to the Internal Revenue Service by February 28 if submitting by paper or March 31 if filing electronically via the Internet.

- Deliver W2s to employees by January 31.

- Deliver 1095s to employees by March 2, if applicable.

- Submit W2s to the Social Security Administration by January 31 if filing by paper or electronically via the Internet.

- Submit 1095/1094 forms electronically to the Internal Revenue Service by March 31, if applicable.

Recordings of the end of calendar year webinars reviewing all the steps on the end of calendar year checklists can be requested from the Training Calendar on our website.

FFCRA Qualified Sick and Family Leave Wages Reporting on W2s

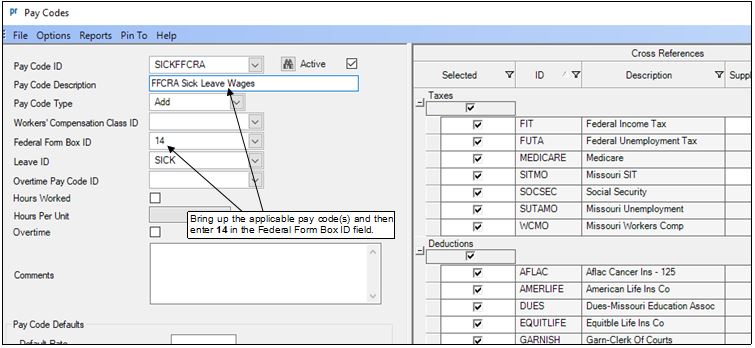

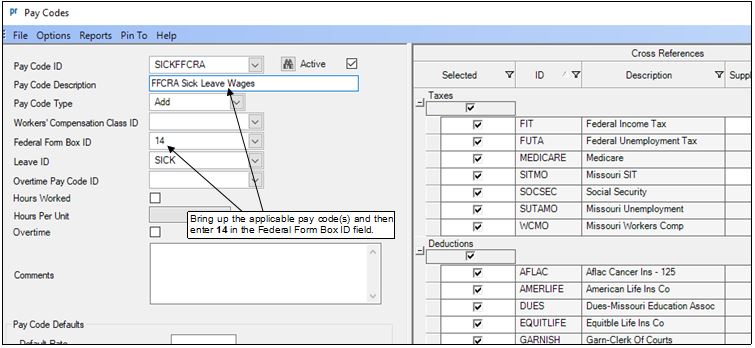

As you are aware, the amounts for qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA) are to be reported in Box 14 on the W2s. To define the applicable pay codes to post to Box 14 on the W2s, complete the following steps:

- In Payroll, select the Maintenance menu and then Pay Codes.

- Bring up the separate pay code(s) that you added for paying the qualified sick and family leave wages.

- Enter 14 in the Federal Form Box ID field, or click the down-arrow button to select Box 14.

- Click the Save button to save the changes.

By completing the Federal Form Box ID field, those wages paid for qualified sick and family leave wages under the FFCRA will post in Box 14 on the W2 for the applicable employees. Keep in mind, the wages paid for qualified sick and family leave wages under the FFCRA will also automatically be included in Boxes 1-6 and 16-19 on the W2, as based on the taxes selected in the Cross References List for the pay code.

For more information on setting up and paying employees for qualified sick and family leave wages under the FFCRA, click here to view the related FAQ.

Note: If the pay code had not been set up correctly (for example, a separate pay code was not defined for paying the qualified sick and family leave wages under the FFCRA), you will need to manually calculate the appropriate amount and edit (add) the amounts in Box 14 on the W2s for the applicable employees once the W2s have been generated; for detailed instructions on editing the W2s, refer to the Editing Employee W2s topic in the Help File.

Updates for the School Accounting System-Online Option

Serving more than 1,000 school districts in 8-states, nearly 80% of our customers have migrated to the School Accounting System-Online (cloud) option.

Beginning soon, we will be updating all online environments to Server 2019. While most of the updates are behind the scenes at the server level, end-users may see a few notable improvements:

User Interface:

- Users will experience quicker login processing.

- Users may notice an updated look and feel more consistent with Windows 10.

- Microsoft Edge is now the default browser when clicking links within the School Accounting System. Note: At this time, Internet Explorer is still the preferred browser to access the School Accounting System-Online login page.

- Links to PDFs and external URLs render properly, most noticeably from the Help File in the School Accounting System.

Security:

- Incoming connections are now filtered to only allow traffic from the United States and Canada. This should add an additional layer of security to the environment to prevent overseas users from gaining access to the hosted environment.

- Better environment stability and performance with the updated Server 2019 technology.

The School Accounting System-Online option allows districts to offload the hardware responsibility to provide you anywhere, anytime access to the School Accounting System, and all updates and backups are all managed for you. This substantially lowers the cost of onsite hardware maintenance, allows you to pay for what you use in the cloud, and enables you to accurately predict cost by eliminating the need to reinvest in expensive, planned or unforeseen hardware upgrades, while ensuring peace of mind that your sensitive financial data is safe and secure.

Support Corner - Amy Feit, Director of Customer Support

SAS-Online – Setup Password Recovery

Security for the School Accounting System-Online option is very important, and a strong password is one way to ensure that your online environment cannot be compromised. Juggling numerous passwords is part of our everyday life, and passwords are easily forgotten if not managed in a password manager application. We see this firsthand in Customer Support when fielding calls from users who forgot their passwords and are unable to log into SAS-Online, which requires a password reset from our team.

We encourage all SAS-Online users to setup the Password Recovery option, so you can take advantage of the “Forgot Password?” link to reset your password without needing assistance from Customer Support. With the ability to work anywhere and anytime, this feature is particularly important outside normal business hours when Customer Support is unavailable.

Click here to review the instructions and watch a short tutorial on how to setup the Password Recovery option within SAS-Online. Please contact Customer Support by using the Request Support link within the School Accounting System, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com with any questions you may have.

SQL Server Upgrade to 2017 Reminder

If you are receiving a “SQL Server Upgrade to 2017 Required” message, this indicates that your SQL Server version (installed on a dedicated server) needs to be upgraded. We strongly encourage you to complete this upgrade as soon as possible. The step-by-step instructions only need to be completed once from the workstation or server hosting the School Accounting System database. Depending on local hardware resources and database size, this upgrade may take up to 30 minutes or more, and all users should exit the School Accounting System prior to running the upgrade. When ready, follow the instructions found here on the machine hosting the database (or forward to your technology coordinator if the database is on a managed server): https://docs.su-inc.com/support/SQL-Express2017InPlaceUpgrade.pdf

Adjust 1099 Amounts Tutorial

The Adjust 1099 Amounts option is used to edit the 1099 amounts for a vendor in Accounts Payable. Click here (or on the image below) to watch a 3-minute video demonstrating how to complete the Adjust 1099 Amounts option.

Easy Access to Documents

By definition, collaboration requires multiple parties (often with different skills and goals) to work together when sharing documents.

- How often do you have to share documents with your colleagues?

- How do you keep track of the shared documents?

- Have you ever had difficulty finding the documents you need because another individual has them?

- Do you make copies of documents to share so the originals don’t leave their folder?

- Are you confident that documents will be where they should be so you can get access to them?

Not being able to easily find documents and share them between several people at the same time is a huge burden for most K-12 organizations. Electronic document management solutions, like K12Docs, provide the ability to quickly search and find the documents you need, when you need them, from anywhere – either from within the School Accounting System or directly through K12Docs in the cloud. K12Docs also allows you to secure the information and share it with the right people. In fact, with K12Docs, you can grant access to an unlimited number of users at no additional cost.

Collaboration in the digital age is fundamentally changing, and K-12 organizations need tools like a document management solution that will help them build a digital workplace that embraces new challenges, promotes agility, and enhances the employee experience.

Electronic document management has many benefits that will make your life easier, keep documents safe and secure, and ultimately save your district money. We invite you to register for a no-cost demonstration of our document management solution called K12Docs to learn about additional benefits and explore why it is a responsible decision to implement an electronic document management system such as K12Docs from Software Unlimited Inc. Click here to learn more.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. How can I get copies of the emails (i.e. reports or direct deposit stubs) sent in the School Accounting System? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, When generating a report, what are the wildcard characters that can be used as placeholders when completing the report parameters? The answer is the percent sign (%), which is a placeholder for an unlimited number of characters, and the underscore ( _ ), which is a placeholder for one character. Congratulations to Mary Lewis from Park County School District #1 for being selected at random from the list of correct respondents and winning a USB flash drive.

Just Married

Tiffany Johnson, who works in the Training Department, married Tyler Kruid on October 3, 2020. The wedding ceremony and reception were held in Sioux Falls. We would like to congratulate the newlyweds and wish them the best! Click here to view a picture of the happy couple.

Closures

Software Unlimited, Inc. will be closed on:

December 24 for Christmas Eve – closed from 12 to 5 p.m.

December 25 for Christmas – closed all day

January 1 for New Year’s Day – closed all day

Staff Spotlight – Erica Haggerty

Erica started working at Software Unlimited, Inc. in 2002. She works in the Customer Support Department and enjoys assisting customers with their questions and issues and helping them get back on track quickly.

In her spare time, Erica enjoys spending time with her husband, Tory, and her two teenagers, Alexis (19) and Miles (14). Erica enjoys hobbies like reading, throwing darts, spending time with friends, and traveling. In 2020, she renewed a deep passion for running. She enjoys distance running on her treadmill and even completed a marathon on it this year. She says it was such an awesome and rewarding experience that she never wants to experience it again!

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Dennis Gourley who is the Business Manager at Great Prairie Area Education Agency and a Mentor at North Mahaska Community Schools. We had these questions for him:

How long have you been using the School Accounting System?

• 25 years

What module do you spend most of your time working in?

• General Ledger

What is your favorite feature in the School Accounting System?

• Favorite features are the Adjust Posted Entries option and the ability to easily crosswalk (change) account numbers; and Customer Service is great.

What is your favorite part of working at Great Prairie Area Education Agency?

• The daily challenges and that there is something new every day. Great Prairie Area Education Agency is highly educated, and the staff is great.

What are your hobbies?

• Yardwork, woodworking, and family time

If you could meet or interview one person (dead or alive), who would it be, and why?

• Thomas Jefferson because he had an incredible mind. Monticello Estate is unbelievable. He was quite a man for his times.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Don’t be afraid to ask your peers questions. There is a wealth of information and experience out there. Don’t reinvent the wheel. Don’t be afraid to contact Customer Support.

On the topic of 1099s: How many 1099s do you typically issue in a calendar year? Will you be issuing both 1099-NEC forms and 1099-MISC forms this year, or just one form or the other?

On the topic of 1099s: How many 1099s do you typically issue in a calendar year? Will you be issuing both 1099-NEC forms and 1099-MISC forms this year, or just one form or the other?