← Back to Newsletter Archives

March 2017 – Volume 21 Issue 1

Are you familiar with all the reports available in General Ledger? For instance, do you know the differences with all the Account Inquiry Reports and the Activity Fund Balance Reports? And are

Are you familiar with all the reports available in General Ledger? For instance, do you know the differences with all the Account Inquiry Reports and the Activity Fund Balance Reports? And are

you aware the Balance Sheet can be generated for Monthly or Annual, or that you can create custom Flexible Financial Reports?

Within the General Ledger module, there are numerous reports available which provide summations of your financial data posted in the School Accounting System. The information that is printed on the various General Ledger reports can range from showing detailed transactions to only summarized data. In addition to the many standard General Ledger reports, the Flexible Financial Report Setup option is also included in the General Ledger module and is a valuable tool that allows users to create customized financial reports.

Below are some helpful hints on a few of the most common reports accessible in General Ledger. To learn more about the most commonly used General Ledger reports, including the ones noted below, as well as the Check Register by Checking Account, Entry File Report, Revenue Summary Report, and Trial Balance Report, click here to request a recording of the new General Ledger Reports Webinar.

Account Inquiry Reports: The Account Inquiry report prints the transactions posted to each account number, along with the totals and budget balance if applicable. The Account Inquiry report is very useful if an employee or administrator wants to see what has been posted to an account this month or fiscal year, or what is left of the budget for a particular account or a mask of accounts (for example, all high school instructional accounts). The Account Inquiry reports are available with several different options: (1) Fiscal Year – prints the transactions for the entire fiscal year; (2) Date Range – prints the transactions for a specific date range; (3) Exclude Encumbrances – omits outstanding invoices or purchase orders; (4) Include Encumbrances – shows both outstanding invoices and purchase orders; (5) Include AP Only – shows only outstanding invoices; and (6) Include PO Only – shows only outstanding purchase orders. Keep in mind, school districts who operate their Accounts Payable on an accrual basis should utilize either the Include PO Only or the Exclude Encumbrances option, as their outstanding invoices are already reflected as an actual expense on the Account Inquiry reports.

Activity Fund Balance Reports: The Activity Fund Balance reports, which are typically generated for only activity funds, provide more options and flexibility with viewing the data for designated fund balance accounts. The Activity Fund Balance Reports have the same options for Exclude Encumbrances, Include Encumbrances, Include AP Only, and Include PO Only as noted above for Account Inquiry reports, but also have these additional three options: (1) Detail – prints every transaction for each account number tied to a fund balance account, along with the total balance; (2) Summary – prints only the totals, including the beginning balance, total revenues, total expenses, and ending balance, for the fund balance accounts; and (3) Account – prints only subtotals for each account number tied to a fund balance account, along with the total balance.

Balance Sheet: The Balance Sheet report offers two report selections when printing: (1) Monthly – prints the regular balance sheet including all the required (control) accounts; and (2) Annual – prints the balance sheet with the current balance of each fund balance account, which is calculated by closing out the control accounts to reflect the net change for the fiscal year. When generating the Balance Sheet for activity funds, always use the Annual option. There is also a Balance Sheet – Combined report available that prints the balance sheet information with each fund as a separate column, for up to a maximum of seven different funds.

Flexible Financial Reports: Financial reports in General Ledger can be modified and created with the Flexible Financial Report Setup option. With the Flexible Financial Report Setup option, the choices for what information to include and the sorting options on the reports are almost endless. Examples of reports that can be created with the Flexible Financial Report Setup option include budget worksheets; cash flow reports; comparison reports with prior fiscal years; expenditure reports sorted by functions, objects, and/or programs with detailed or summarized information; monthly expenditure reports showing monthly totals in the fiscal year; and revenue/expenditure summary reports with profit and loss. To learn how to create custom reports using the Flexible Financial Report Setup option in General Ledger, click here to request a recording of the Flexible Financial Report Setup Webinar.

Newsletter Survey

On the topic of General Ledger reports: What report in General Ledger do you print most frequently? When generating the Account Inquiry, which option do you typically select for what to include (or exclude)? Have you used the Flexible Financial Report Setup option in General Ledger to build custom financial reports?

On the topic of General Ledger reports: What report in General Ledger do you print most frequently? When generating the Account Inquiry, which option do you typically select for what to include (or exclude)? Have you used the Flexible Financial Report Setup option in General Ledger to build custom financial reports?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

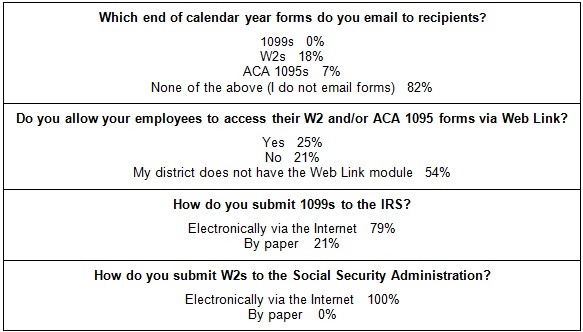

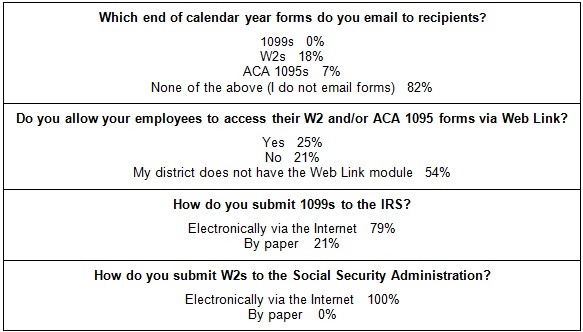

The Newsletter Survey question for the December 2016 issue related to end of calendar year forms. The questions were… Which end of calendar year forms do you email to recipients? Do you allow your employees to access their W2 and/or ACA 1095 forms via Web Link? How do you submit 1099s to the IRS? How do you submit W2s to the Social Security Administration?

Thanks to everyone who participated in our survey!

Coming Soon: Leave Request via Web Link

More than 30% of customers are currently taking advantage of the Web Link add-on module, and the module is designed as a web-integrated extension of the School Accounting System to facilitate:

More than 30% of customers are currently taking advantage of the Web Link add-on module, and the module is designed as a web-integrated extension of the School Accounting System to facilitate:

1. Online Requisition entry with an electronic approval process

2. Online Purchase Order entry

3. Online Cash Receipt entry with receipt printing

4. Online Check Stub, W2, 1095, and Leave Balance information for district employees

5. Online viewing and printing of School Accounting System reports for district administrators

6. Online integration with the Fixed Asset Inventory module to help expedite annual room inventory process

In the coming months, we will be releasing a Leave Request feature that is integrated with Leaves in the Payroll module. The workflow will be accommodated by entry and an approval process through the Web Link module.

The key benefit of web-based technology is that any computer with an Internet browser (Mac or PC) can access key areas of the School Accounting System and requires no installation on individual workstations. Furthermore, Web Link is written in a stable programming language and has been designed to be configured with various levels of security to help keep financial and employee data secure.

To learn more, visit the Web Link product page on our website at https://www.su-inc.com/product/web-link/, or please contact sales@su-inc.com for more information on this exciting new enhancement.

End of Fiscal Year Training

With spring arriving, that means the end of the fiscal year is not far off. To prepare yourself for the upcoming end of fiscal year activities that must be completed within the School Accounting System, register to attend an end of fiscal year training.

With spring arriving, that means the end of the fiscal year is not far off. To prepare yourself for the upcoming end of fiscal year activities that must be completed within the School Accounting System, register to attend an end of fiscal year training.

All of the end of fiscal year workshops and webinars are currently listed on the Training Calendar on our website. The various trainings cover the End of Fiscal Year Checklists for Accounts Payable, Payroll, General Ledger, and/or Fixed Asset Inventory. Keep in mind, the End of Fiscal Year Workshops encompass all topics for ending the fiscal year, while the webinars include only the designated topics.

New and experienced users alike are encouraged to register for end of fiscal year training. If this is your first end of fiscal year using the School Accounting System, the Hands-On End of Fiscal Year Workshop is the recommended class to attend.

To view a list of the upcoming trainings and/or to register, click here to access the Training Calendar.

Support Corner - Amy Feit, Director of Customer Support

Our goal in Customer Support is simple – we want to ensure you have a positive experience with our products and have as many resources at your fingertips as possible. We have always focused heavily on delivering timely and exceptional customer service. In fact, more than 50% of your calls are answered by a live Customer Support Representative.

With that in mind, I would like to take the opportunity to remind you that you have unlimited access to our knowledgeable Customer Support team with your annual maintenance fees, so please do not hesitate to call 800.756.0035; and be sure to dial extension 2 to be directed to a live representative. If your preferred method of contact is email, we can be reached at support@su-inc.com. A detailed list of our contact information, along with office hours, support call procedures, and call prioritizations can be found on our website: https://www.su-inc.com/support/contact-procedures/

If a question comes up outside of normal business hours, or if you like to try to track down the answer yourself first, there are many resources to aide in your search:

- Help File: The School Accounting System includes a comprehensive, searchable help file which can be accessed by selecting the Help menu from any screen within the software.

- Knowledge Base: A searchable list of all of our Frequently Asked Questions (FAQs) and Training Tidbits can be accessed on our website: https://www.su-inc.com/training/knowledge-base/

If you ever have any questions or concerns about the level of service you are receiving, I want to hear from you. I invite you to contact me directly with any concerns or accolades you would like to share with regards to the support you have received:

Amy Feit, Director of Customer Support

800.756.0035 ext. 119

alf@su-inc.com

Adjust Posted Entries Video Tutorial

The Adjust Posted Entries option in General Ledger is used to correct (change) account numbers on the entries posted from Accounts Payable and Payroll. Click here (or on the image below) to view a 3-minute video demonstrating the Adjust Posted Entries option.

Thank You for Your Feedback!

We appreciated the fantastic response rate on Our Annual Customer Satisfaction Survey, and many of you shared valuable feedback and ideas on how we can continue to improve the School Accounting System and add-on modules.

We appreciated the fantastic response rate on Our Annual Customer Satisfaction Survey, and many of you shared valuable feedback and ideas on how we can continue to improve the School Accounting System and add-on modules.

Your guidance is important to help us steer development to meet your needs now and in the future, and we encourage you to continue submitting your feedback, suggestions, and ideas through our program suggestion form on our website.

We understand your time is valuable, and as a thank you and incentive, all who shared their name on the survey were entered to win one of five (5) Amazon Kindle Fire® tablets. Thank you and congratulations to:

Cindy Knudsen – Vermillion School District, SD

Tammara Price – Converse County School District #2, WY

Alicia O’Dell – Davis County Community School District, IA

Jennifer Feeken – Dorchester Public Schools, NE

Deb Baker – Morrill Public Schools, NE

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. How can you set the system to automatically copy selections to the Sub Heading when generating a report without needing to click the Copy Choices button? Click here to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option can be used to set the order the items post into Box 14 on W2s? The answer is the W2 Box 14 Default Order option, which is accessed under the Options menu in the Deduction or Pay Code File. Congratulations to Teresa Ott from Boone Community School District in Iowa for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

May 29 for Memorial Day

On the Move

Lee Marotz, who has been with Software Unlimited, Inc., for 6 years in our Customer Support Department, recently moved to a new position as Information Technology Analyst. Lee’s primary focus will be assisting customers with their hardware and network related questions, while also supporting Software Unlimited’s internal network and hardware.

Congratulations to Lee on his new position!

Staff Spotlight - Russ Durand

Russ joined the Software Unlimited, Inc. family last fall in August as our Sales and Marketing Representative. Russ brings over 12 years of experience with software sales in the education field and loves the privilege of working directly with K-12 schools in the Midwest. Russ spends most of his free time with his family, wife Eva, son Peyton (17), and daughter Alyson (14). Outside of work, Russ keeps busy playing guitar and singing on Sunday mornings in his church’s Worship Band and assisting his wife with their church’s Jr. and Sr. High youth group. Russ is an avid Nebraska football fan and also enjoys reading, going to movies, walking the family dogs, and constantly re-watching the early 2000’s TV series Lost.

On the topic of General Ledger reports: What report in General Ledger do you print most frequently? When generating the Account Inquiry, which option do you typically select for what to include (or exclude)? Have you used the Flexible Financial Report Setup option in General Ledger to build custom financial reports?

On the topic of General Ledger reports: What report in General Ledger do you print most frequently? When generating the Account Inquiry, which option do you typically select for what to include (or exclude)? Have you used the Flexible Financial Report Setup option in General Ledger to build custom financial reports? Are you familiar with all the reports available in General Ledger? For instance, do you know the differences with all the Account Inquiry Reports and the Activity Fund Balance Reports? And are

Are you familiar with all the reports available in General Ledger? For instance, do you know the differences with all the Account Inquiry Reports and the Activity Fund Balance Reports? And are

More than 30% of customers are currently taking advantage of the Web Link add-on module, and the module is designed as a web-integrated extension of the School Accounting System to facilitate:

More than 30% of customers are currently taking advantage of the Web Link add-on module, and the module is designed as a web-integrated extension of the School Accounting System to facilitate: With spring arriving, that means the end of the fiscal year is not far off. To prepare yourself for the upcoming end of fiscal year activities that must be completed within the School Accounting System, register to attend an end of fiscal year training.

With spring arriving, that means the end of the fiscal year is not far off. To prepare yourself for the upcoming end of fiscal year activities that must be completed within the School Accounting System, register to attend an end of fiscal year training.

We appreciated the fantastic response rate on Our Annual Customer Satisfaction Survey, and many of you shared valuable feedback and ideas on how we can continue to improve the School Accounting System and add-on modules.

We appreciated the fantastic response rate on Our Annual Customer Satisfaction Survey, and many of you shared valuable feedback and ideas on how we can continue to improve the School Accounting System and add-on modules.