← Back to Newsletter Archives

June 2022 – Volume 26 Issue 2

The Adjust Posted Entries option, which is accessed under the Options menu in General Ledger, is a great alternative for making corrections instead of completing manual journal entries. The Adjust Posted Entries option is used to correct (change) an account number included on the following posted items:

- Cash receipts in General Ledger

- Checks in Accounts Payable – applicable if operating on a cash basis

- Invoices in Accounts Payable – applicable if operating on an accrual basis

- Checks (with earnings) in Payroll

The Adjust Posted Entries option is simple to use. When completing the Adjust Posted Entries option, reversing entries are automatically posted to the original account numbers, and then additional, correcting entries are posted to the newly, specified account numbers, using the same date as the original entries. If correcting an account number on an employee’s Payroll check using the Adjust Posted Entries option, only the salary expense account number is able to be adjusted (changed), because the system automatically adjusts the benefit expenses using the appropriate accounts.

One advantage for making corrections using the Adjust Posted Entries option, as compared to completing manual journal entries, is that the correcting entries from the Adjust Posted Entries option are reflected in the applicable options and reports within the corresponding modules (with one exception—the account numbers on the entries in the Payroll data entry batches will still reflect only the original account numbers on the applicable listings while all the Payroll calculation reports will include the adjusting entries).

For step-by-step instructions on using the Adjust Posted Entries option, refer to the Adjusting Posted Entries topic in the Help File, or click here to view the tutorial demonstrating the Adjust Posted Entries option.

Newsletter Survey

On the topic of the Adjust Posted Entries option: Have you utilized the Adjust Posted Entries option in the past? If so, which tab within the Adjust Posted Entries option do you use the most often? How often do you complete the Adjust Posted Entries option?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

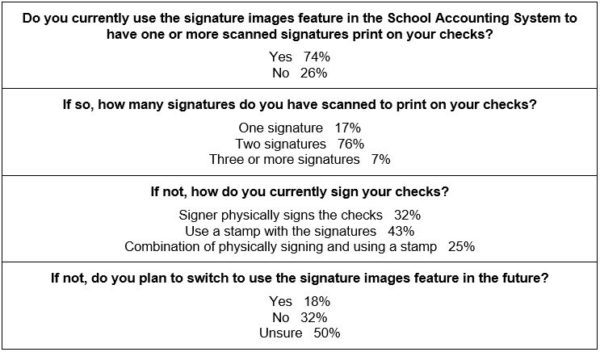

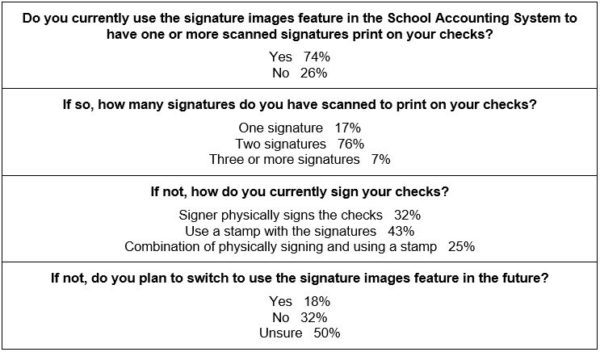

The Newsletter Survey questions for the March 2022 issue related to the signature images feature with checks. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

End of Fiscal Year Reminders

As you complete the fiscal year activities in the School Accounting System and generate the annual report, be sure to follow the steps as outlined on the end of fiscal year checklists to ensure all steps are completed and nothing is missed.

The end of fiscal year checklists to complete include:

Keep in mind, the end of fiscal year checklists for Accounts Payable, Payroll, and Fixed Asset Inventory (if applicable) must be completed before doing the end of fiscal year checklist for General Ledger.

If needed, recordings of the End of Fiscal Year Checklist Webinars for Accounts Payable, Payroll, General Ledger, and Fixed Asset Inventory can be requested from the Training Calendar on our website.

Employment Verification Report

Have you ever had to complete the Fannie Mae Request for Verification of Employment form for employees? Did you know there is a report within the Payroll module that will assist you in completing that form?

The Fannie Mae Request for Verification of Employment form is typically requested by lenders when employees are seeking mortgages. When requested, you can generate the Employment Verification Report, accessed under the Reports menu and Employee Reports grouping in Payroll, to assist you in completing the Fannie Mae Request for Verification of Employment form. Click here to view a sample of the Employment Verification Report generated for a contract employee for the current calendar year and the past two calendar years.

K12Docs Resources

For those organizations with K12Docs licensed, there are a variety of resources available for help with using K12Docs, including training handouts, short video tutorials, webinar recordings, and end user manuals.

Handouts:

- K12Docs Handouts – topics include terminology and structure; viewing and adding a document in K12Docs; indexing documents from lists in K12Docs; and moving a misfiled document in GX

- K12Docs Integration with School Accounting System Handouts – topics include the K12Docs Setup Checklist for integration with the School Accounting System; adding and viewing documents from within the School Accounting System; emailing documents from within the School Accounting System; completing a document inquiry from within the School Accounting System; and uploading a report from within the School Accounting System to K12Docs

- Host Site Manager Handouts – topics include adding a new user; assigning roles to users; and adding new values to a document attribute drop-down list

- K12Docs Advanced Topics Handouts – topics include E-sign; annotations; export search results; fulltext search; AuditShield; search activity workflows; and adding indexes, attributes, and subfolders (in Host Site Manager)

Video Tutorials:

- Click here to access the library of K12Docs Training Tutorials

Webinar Recordings:

End User Manuals:

For additional resources available for K12Docs, click here to view the Training Tidbit for K12Docs Training Resources.

Support Corner - Amy Feit, Director of Customer Support

Microsoft® Retirement of Internet Explorer (IE11)

After June 15, 2022, Microsoft began its retirement of Internet Explorer and is being replaced by Microsoft Edge. As you might have already noticed, after this date, when launching IE11, you might be redirected to Microsoft Edge. For more information on the IE11 retirement, click here.

Internet Explorer was previously the recommended browser when logging into our School Accounting System-Online (SAS-Online) version. While IE11 was not a requirement for login to SAS-Online, it did provide a convenient single sign-on experience. With the retirement of IE11, here are a few tips for any PC users logging into SAS-Online:

- Use any preferred browser for logging into SAS-Online. Review the login instructions found here for some helpful hints and instructions.

- If you previously had a desktop icon set up for launching the SAS-Online through IE11, you will likely be redirected to a Microsoft Edge landing page. If you are not redirected to the SAS-Online site as desired, we recommend deleting this desktop icon and see the previous bullet for some helpful hints for logging into SAS-Online.

- Microsoft has made an IE Mode available in Microsoft Edge to allow users to launch sites in a compatibility mode with IE11. While not necessary or recommended, if you would like to enable the IE Mode, review the following link with your technology coordinator to determine if this would be something you wish to enable: https://microsoftedgewelcome.microsoft.com/en-us/mb04?form=MA13E6&slide=ie-mode

If you have any questions, please contact Customer Support by submitting a support request through the School Accounting System, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Moving a Misfiled Document Tutorial

For organizations with K12Docs, a document that has been misfiled within K12Docs can be moved to its correct location from within GX. Click here (or on the image below) to watch a 4-minute video demonstrating how to move a misfiled document.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. What option is used to create the new year for leaves in Payroll? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option is used to merge two vendor records that are for the same company into one record? The answer is the Combine IDs option, which is accessed under the Options menu from within the Vendor File in Accounts Payable. Congratulations to Cara Reichert from Sheridan County School District 1 for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

July 4 for Independence Day

September 5 for Labor Day

Convention Winners

Congratulations to the grand prize winners of an Amazon Echo Show 8®. The following people won by registering at our convention booth. Thanks to all who stopped by our booth to register and say “Hi”. We greatly appreciate your support and participation. Remember to look for the Software Unlimited, Inc. booth at the next convention and maybe you will be the next winner!

Winner at the SDASBO Conference in Pierre, SD

Makenzie Miles from Montrose School District

Winner at the NASBO Conference in Lincoln, NE

Julie Ehlers from Oakland-Craig Public Schools

Winner at the IASBO Conference in Boise, ID

Lisa Loy from Coeur d’Alene School District #271

Staff Spotlight - Pat Simpson

Pat joined the support team in March 2022. She enjoys getting to know the customers and help them work through problems with the software. She likes spending her free time with family and friends. She also enjoys gardening, yard work, and cooking.

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Kelly Allen who is the Board Secretary/School Business Official at AHSTW Community School District in Avoca, IA. We had these questions for her:

How long have you been using the School Accounting System?

• I’ve been using the software for 10 years now.

What module do you spend most of your time working in?

• I spend most of my time in General Ledger and Payroll, as I have someone who does Accounts Payable.

What is your favorite feature in the School Accounting System?

• Creating contracts for the new year and how it can copy information from the prior year. I like that there is the Create Payroll Wages for New Year option that can do it for a group of employees, or how you can do it individually on the Wages screen. I like the flexibility that it allows.

What are three words you would use to describe the School Accounting System?

• User-friendly, timely customer service, and efficient.

What is your favorite part of working at your district?

• The people I work with.

What are your hobbies?

• I like spending time with my family—not just my immediate family but also my siblings and in-laws.

If you could meet or interview one person (dead or alive), who would it be, and why?

• Tom Petty because I love his music. I listen to Sirius XM Radio Channel 31 and love “Cabin Down Below” and “Honey Bee” which are songs that were never on mainstream radio.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Don’t be afraid to contact customer support. It doesn’t matter how big or small, no question is a dumb question.