← Back to Newsletter Archives

December 2016 – Volume 20 Issue 4

As the end of the calendar year approaches, we know you will be busy preparing and issuing 1099, W2, and ACA 1094/1095 forms. To ensure all steps are completed, use the Accounts Payable and Payroll End of Calendar Year Checklists accessed in the Help File (or click the links below).

As the end of the calendar year approaches, we know you will be busy preparing and issuing 1099, W2, and ACA 1094/1095 forms. To ensure all steps are completed, use the Accounts Payable and Payroll End of Calendar Year Checklists accessed in the Help File (or click the links below).

Also, following are a few reminders and tips to help you during the end of calendar year process.

Accounts Payable End of Calendar Year Reminders:

- Deliver 1099s to recipients by January 31

- 1099s can be printed and sent to vendors, or emailed to vendors.

- Submit 1099s to IRS by January 31 – applicable if filing by paper or electronically

- Must file electronically via the Internet if 250 or more 1099s (same type); however, everyone is encouraged to file electronically to avoid scanning problems – http://fire.irs.gov

- Must have prior approval from the IRS before submitting a 1099 file electronically via the Internet; complete and submit Form 4419 for application of approval at least 45 days before the due date of the return: http://www.irs.gov/pub/irs-pdf/f4419.pdf

- Submitting 1099s to States:

- Illinois – 1099 information should not be submitted with the state unless the state requests the information.

- Iowa – 1099 information may be filed electronically with the state by January 31 for Tax Year 2016, but is not required (will be required for Tax Year 2017) – https://tax.iowa.gov/efile-pay

- Kansas – 1099 information must be filed electronically to the state by February 28 if reporting 51 or more records, or by paper if 50 or less – http://www.ksrevenue.org/kswebtax.html

- Missouri – 1099 information must be submitted by paper to the state by February 28 for those with totals of $1,200 or higher.

- Nebraska – 1099 information must be filed electronically to the state by February 1 if reporting more than 50 records, or by paper if less than 50 – https://ndr-efs.ne.gov/revefs/allPages/login.faces

- North Dakota – 1099 information must be filed electronically (or via electronic media, including CD, flash drive, or emailed) by January 31 if reporting 250 or more records, or by paper if less than 250 – https://apps.nd.gov/tax/tap/_/

- Use the Adjust 1099 Amounts option, which is found under the Options menu in the Vendor File, to enter an adjustment for a 1099 amount for a vendor, if needed.

- To add a second name and specify which line the additional name needs to print on the 1099, complete the Additional Recipient Name and Print Location fields on the Miscellaneous tab in the Vendor File.

Payroll End of Calendar Year Reminders for W2s:

- Deliver W2s to employees by January 31

- W2s can be printed and distributed to employees, emailed to employees, or made available for employees to access via Web Link.

- Submit W2s to SSA by January 31 – applicable if filing by paper or electronically

- Submitting W2s to States:

- Illinois – W2 information must be submitted electronically to the state by February 15 if reporting 250 or more records – https://www.revenue.state.il.us/app/wtri/

- Iowa – W2 information must be submitted electronically to the state by January 31 for Tax Year 2016 if reporting 50 or more employees; those with less than 50 employees may file electronically but are not required to do so (will be required for Tax Year 2017) – https://tax.iowa.gov/efile-pay

- Kansas – W2 information must be filed electronically to the state by February 28 if reporting 51 or more records, or by paper if 50 or less – http://www.ksrevenue.org/kswebtax.html

- Missouri – W2 information must be submitted by CD or flash drive to the state by February 28 if reporting 250 or more records, or by paper if less than 250.

- Nebraska – W2 information must be filed electronically to the state by February 1 if reporting more than 50 records, or by paper if less than 50 – https://ndr-efs.ne.gov/revefs/allPages/login.faces

- North Dakota – W2 information must be filed electronically (or via electronic media, including CD, flash drive, or emailed) by January 31 if reporting 250 or more records, or by paper if less than 250 – https://apps.nd.gov/tax/tap/_/

- Verify any new employee Social Security Numbers using the SSN Verification Service option, which is found under the Government Reporting menu in Payroll. We strongly recommend verifying all of your employees Social Security Numbers each year.

- Complete the Balancing Information option, accessed under the Options or Check Cycle menu in Payroll, to balance the tax formulas for W2s and determine the employees causing variances, if applicable. Remember, the Balancing Information option can be used with every payroll throughout the year to ensure that employee W2s will balance at year-end.

Payroll End of Calendar Year Reminders for ACA 1094/1095s:

- Deliver 1095s to employees by March 2 (was extended for Tax Year 2016)

- Submit 1094/1095s to IRS by March 31 – applicable if filing electronically

- To submit the 1094/1095s electronically, there is a direct connection to the Internal Revenue Service’s ACA Information Return (AIR) application from within the School Accounting System; this makes the process to file electronically very simple and secure, and does not require any pre-authorization or approval process.

- For organizations issuing 1095-C forms, utilize the Adjust ACA Employee Offer of Coverage option to quickly complete or edit the data in the Employee Offer of Coverage List on the ACA 1095s screen in the Employee File for a group of employees, or copy the data entered for a prior calendar year for a group of employees.

- For self-insured organizations only, the information for the coverage dates of the employees (in the Employee ACA Coverage Dates List on the ACA 1095s screen in the Employee File), along with the information for the covered dependents (in the Dependents and Dependent ACA Coverage Dates Lists), can be imported using a file obtained from your third-party administrator.

If desired, recordings of the end of calendar year webinars can be requested from the Training Calendar on our website.

Newsletter Survey

On the topic of end of calendar year forms: Which end of calendar year forms do you email to recipients? Do you allow your employees to access their W2 and/or ACA 1095 forms via Web Link? How do you submit 1099s to the IRS? How do you submit W2s to the Social Security Administration?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

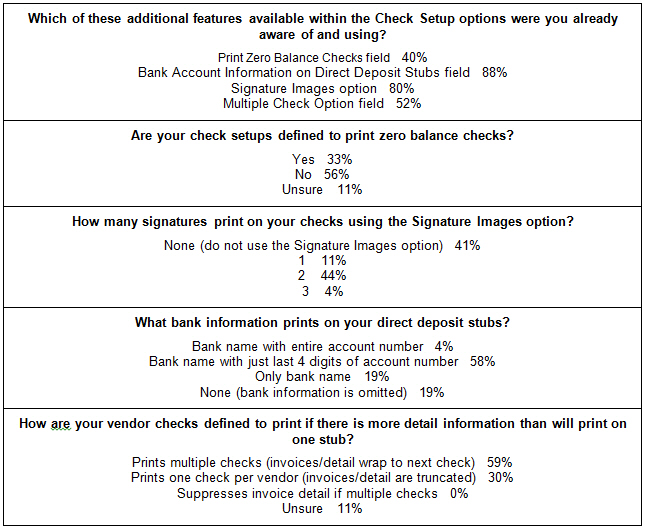

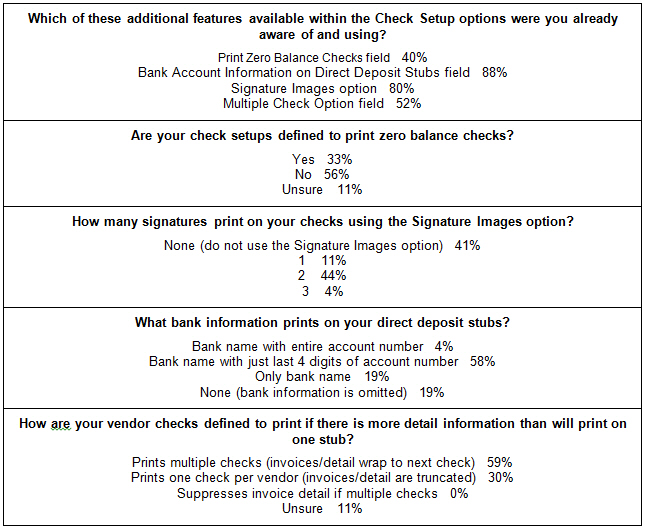

Previous Survey Results

The Newsletter Survey question for the September 2016 issue related to Check Setup options. The questions were… Which of the additional features available within the Check Setup options were you already aware of and using? Are your check setups defined to print zero balance checks? How many signatures print on your checks using the Signature Images option? What bank information prints on your direct deposit stubs? How are your vendor checks defined to print if there is more detail information than will print on one stub?

Thanks to everyone who participated in our survey!

Support Corner - Amy Feit, Director of Customer Support

2016 In Review

As we come to the end of 2016, I would like to take a moment to reflect on the year for Customer Support.

We take great pride in delivering quality customer support for our products in a timely and professional manner. So far this year, I am pleased to report that of the more than 25,000 inquiries fielded by Customers Support, well over 50% were answered live by a representative – a level of response time unmatched in our industry.

We understand your time is valuable, and that is why we take great pride in being immediately available when you call for assistance. In addition to promptness, another highly important aspect is the quality of our interactions – we strive to handle each interaction with the thoroughness needed to keep your day running smoothly.

As we embark on the new year, you can be assured that our knowledgeable support staff will continue to provide the same reliable and accurate service that you have come to expect from Software Unlimited. So as you work through balancing and generating your W2s and 1099s, generating the needed information for the Affordable Care Act, and everything in between, we hope that you will enjoy a more relaxing holiday season knowing that the reliable service you have come to expect from Software Unlimited, Inc. is just a phone call away.

Happy Holidays!

Adjust 1099 Amounts Video Tutorial

The Adjust 1099 Amounts option in Accounts Payable is used to add or change 1099 amounts for a vendor. Click here (or on the image below) to watch a 3-minute video demonstrating the Adjust 1099 Amounts option.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. What option can be used to set the order the items post into Box 14 on W2s? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, Where can you view the list of changes and enhancements included in an update? The answer is clicking the Latest Release Notes link under the Information section on a main screen in the School Accounting System (or clicking the post for the update in the News Feed on the left side of the main screen). Congratulations to Clara Waterbury from South Central School District for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

December 26 for Christmas

January 2 for New Year’s Day

Convention Winners

Congratulations to the grand prize winners of an Amazon Kindle Fire®. The following people won by registering at our convention booth. Thanks to all who stopped by our booth to register and say “Hi”. We greatly appreciate your support and participation. Remember to look for the Software Unlimited, Inc. booth at the next convention and maybe you will be the next winner!

Winner from NDSBA Convention in Bismarck, ND

Cathi Heuchert, Business Manager, from Grafton School District

Winner from WSBA Educational Trade Fair in Casper, WY

Bruce Thoren, Superintendent, from Fremont County School District #24

Staff Spotlight - Laura Kearney

Laura has been with Software Unlimited, Inc. since 2004. She has held a few positions including Customer Support Representative, New School Coordinator, Quality Analyst, and is currently a Software Developer. In her free time, she can usually be found at home, enjoying time with her husband and one year old son. She usually spends a few weeks in Arizona in the winter enjoying the warm weather, and likes to travel as time allows.

As the end of the calendar year approaches, we know you will be busy preparing and issuing 1099, W2, and ACA 1094/1095 forms. To ensure all steps are completed, use the Accounts Payable and Payroll End of Calendar Year Checklists accessed in the Help File (or click the links below).

As the end of the calendar year approaches, we know you will be busy preparing and issuing 1099, W2, and ACA 1094/1095 forms. To ensure all steps are completed, use the Accounts Payable and Payroll End of Calendar Year Checklists accessed in the Help File (or click the links below).