← Back to Newsletter Archives

December 2021 – Volume 25 Issue 4

As you begin working on the end of calendar year tasks, be sure to complete the SSN Verification Service option to verify your employees’ social security numbers before generating W2s and 1095s. The SSN Verification Service option in the School Accounting System creates a file containing the names, social security numbers, and birthdates of selected employees. Then the file is uploaded to the Social Security Administration’s Business Services Online (BSO) website for verification. The results of the verification process can be downloaded and then viewed from within the School Accounting System.

The Social Security Administration recommends verifying the names and social security numbers of your employees to ensure the employee records submitted to the Internal Revenue Service are correct. Completing the SSN Verification Service option results in more accurate wage report submissions, and thus helps reduce the chance of needing to prepare and submit W2c’s. It also allows the Social Security Administration to properly credit the earnings records for your employees, which is important in determining their Social Security benefits in the future.

In order to submit a file to the Social Security Administration for verification, you must first sign up for the Social Security Number Verification Service (SSNVS) from within the BSO website, which will require a pre-authorization process. For more information, go to http://www.ssa.gov/employer/ssnv.htm and complete the instructions under the Steps to Register for SSNVS section to register, request access, and request an activation code.

For step-by-step instructions on completing the SSN Verification Service option within the School Accounting System, see the Completing SSN Verification topic in the Help File, or click here to request the recording of the SSN Verification Service Webinar.

Newsletter Survey

On the topic of the Social Security Number Verification Service: Have you completed the SSN Verification Service option within the School Accounting System in the past? If applicable, how often do you complete (or plan to complete) the SSN Verification Service option within the School Accounting System? Have you ever received surprising results from the verification process?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

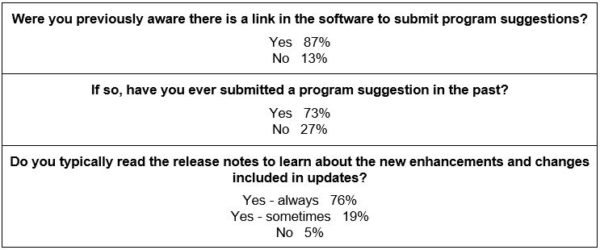

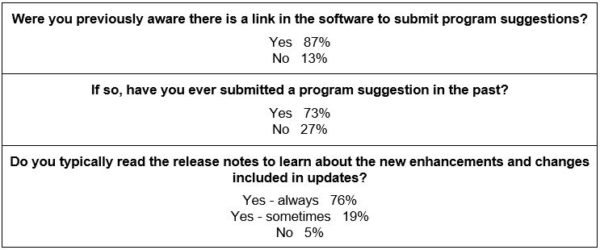

The Newsletter Survey questions for the September 2021 issue related to program suggestions and enhancements. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

Are You Balancing Each Payroll?

The Balancing Information option, which is accessed from under the Check Cycle or Options menu on the Payroll screen, completes the calculation of the formulas for taxes used to balance W2s. We recommend completing the Balancing Information option with each payroll check cycle throughout the year to ensure the formulas balance for W2s at the end of the calendar year.

When first using the Balancing Information option, the appropriate categories for the deductions to include must be specified, along with selecting the applicable pay codes and pay groups to include in the calculations. After the pay group, deduction, and pay code specifications are defined, the system will retain the selections each time the option is accessed.

The formulas computed and displayed within the Balancing Information option include the Gross Earnings, FIT Gross, SIT Gross, Medicare Gross, Social Security Gross, and FIT/Medicare Gross Comparison. If a formula has a variance (does not balance between what is calculated and the actual amount), the employees causing the variances can be viewed so that the necessary corrections can be made.

Tip for Missouri and Illinois: Organizations in Missouri and Illinois can utilize the Has Employees Exempt from Social Security field located on the Deductions tab within the Balancing Information option. The Has Employees Exempt from Social Security field is only enabled for deductions with the State Retirement System Deduction field (column) selected. Missouri and Illinois organizations should select the Has Employees Exempt from Social Security field (column) for a retirement deduction if the employees set up with that deduction are not subject to Social Security. Then when on the View Data screen, the Exempt from Social Security field in the Social Security Gross formula reflects the amount of the gross earnings for employees exempt from Social Security and the amount is subtracted from the formula. For more information on accounting for employees exempt from Social Security for Missouri and Illinois organizations, click here to view the FAQ on the topic.

For detailed instructions on using the Balancing Information option, refer to the Balancing Information topic in the Help File, or click here to request the Balancing Information Option Webinar recording.

End of Calendar Year Reminders

The end of calendar year is quickly approaching! And as you get ready to complete the end of calendar year activities, including preparing 1099s, W2s, and 1095s, review the tips and deadlines below.

Tips:

- Follow the instructions on the Accounts Payable End of Calendar Year Checklist and Payroll End of Calendar Year Checklist to be sure all steps are completed.

- Nonemployee compensation payments of $600 or more to unincorporated vendors are reported on the 1099-NEC form; payments for miscellaneous items, including rents, prizes and awards, medical and health care payments, and gross proceeds paid to an attorney, are reported on the 1099-MISC form.

- For 1099s, if needed, complete the Additional Recipient Name and Print Location fields on the Miscellaneous tab in the Vendor File to add a second name for a vendor to print on the 1099.

- Use the Adjust 1099 Amounts option to enter an adjustment for a 1099 amount for a vendor.

- Complete the SSN Verification Service option in Payroll to verify the Social Security Numbers and names of your employees to ensure the forms that will be issued include correct information.

- Employers are required to report the amount of qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA) or the American Rescue Plan Act of 2021 (ARPA) in Box 14 on the W2, or in a statement provided with the W2. For more information, click here to view the FAQ on the topic.

- For W2s, define the order items will post and print in Box 14 for employees by using the W2 Box 14 Default Order option. Reminder, only nine items will post to Box 14 for an employee, with only the first four of those posted items actually being printed on the W2.

- Allow time for your employees to review their W2s and 1095s before submitting the returns to the government.

Important Deadlines:

- Deliver 1099-NEC and 1099-MISC forms to vendors by January 31.

- Submit 1099-NEC forms to the Internal Revenue Service by January 31 if filing by paper or electronically via the internet.

- Submit 1099-MISC forms to the Internal Revenue Service by February 28 if submitting by paper or March 31 if filing electronically via the internet.

- Deliver W2s to employees by January 31.

- New extension just announced: Deliver 1095s to employees by March 2, if applicable.

- Submit W2s to the Social Security Administration by January 31 if filing by paper or electronically via the internet.

- Submit 1095/1094 forms electronically to the Internal Revenue Service by March 31, if applicable.

Recordings of the end of calendar year webinars reviewing all the steps on the end of calendar year checklists can be requested from the Training Calendar on our website.

Support Corner - Amy Feit, Director of Customer Support

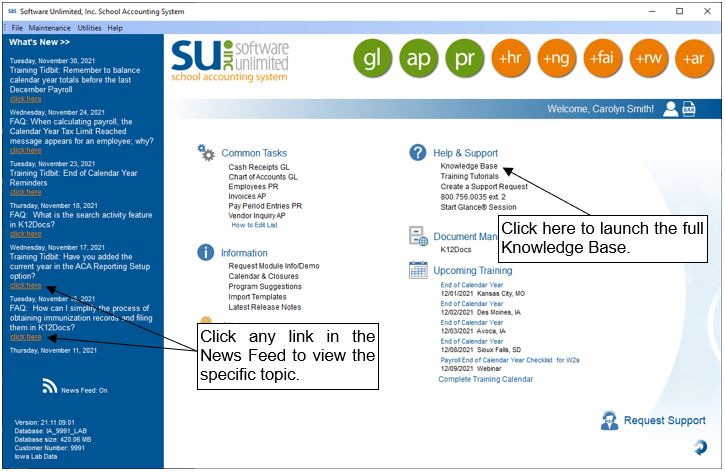

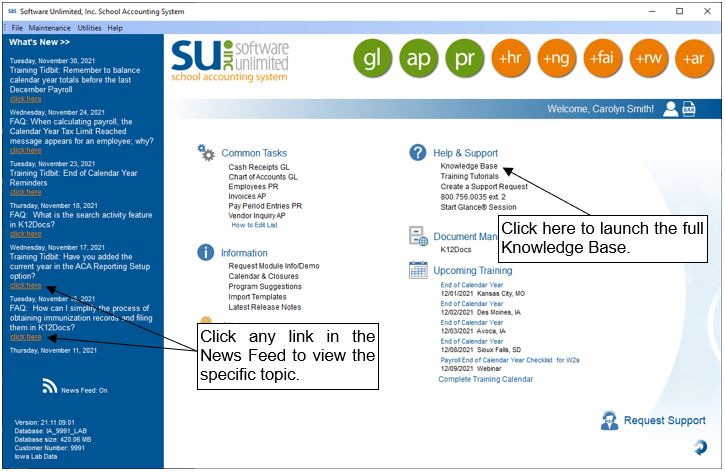

Knowledge Base Now Even Easier to Access

As you might have noticed, we recently made some important updates to our website at www.su-inc.com. One of the most exciting changes is the removal of the login requirements to access the Knowledge Base. As a result, accessing this wealth of information is even easier than ever!

The Knowledge Base can be accessed by several ways:

- Click the link found under the Help & Support section of any of the main module screens to open the entire Knowledge Base home page and search for specific articles.

- Click the link on any of the items in the News Feed to view the specific topic in the Knowledge Base.

- Open a Knowledge Base article from a link sent to you from Customer Support.

If you have any questions on how to access the Knowledge Base or would like assistance searching for a topic, please contact Customer Support by submitting a support request through the School Accounting System, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Customer Surveys: We appreciate your feedback!

We understand your time is valuable, and we want to help you save more of it through product and service enhancements. Please keep an eye on your inbox for opportunities to share your feedback, rate how we are doing, and suggest how we can improve.

Your comments and suggestions are crucial for future enhancements. You are truly driving the development of the School Accounting System, and ultimately, saving yourself time by making the system better for you and your colleagues.

We thank so many of you who have taken the time to share your feedback, and we look forward to hearing from you on the next survey!

W2 Box 14 Default Order Tutorial

The W2 Box 14 Default Order option is used to set the default order in which the deductions and pay codes will post and print in Box 14 for employees. Click here (or on the image below) to watch a 5-minute video demonstrating the W2 Box 14 Default Order option.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. Where do you set the requirements for user passwords (such as requiring uppercase and lowercase letters, special characters, and numbers) in the School Accounting System? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option can be used to verify the social security numbers for employees entered in Payroll? The answer is the SSN Verification Service option accessed under the Government Reporting menu in Payroll. Congratulations to Michelle Johnson from Fessenden-Bowdon School District 25 for being selected at random from the list of correct respondents and winning a USB flash drive.

Baby Block

Congratulations to Juliane and Colin! Juliane, who works in our Training Department, and her husband Colin, welcomed a new baby boy to their family. Beckham Colin was born on September 20 weighing 8 pounds.

Congratulations to Juliane and Colin! Juliane, who works in our Training Department, and her husband Colin, welcomed a new baby boy to their family. Beckham Colin was born on September 20 weighing 8 pounds.

Congratulations to Kim and Vinny! Kim, who works in our Development Department, and her husband Vinny, welcomed a new baby girl to their family. Elodie Mae was born on November 9 weighing 5 pounds 5 ounces. Elodie has three big brothers – Keegan, Easton, and Camden.

Closures

Software Unlimited, Inc. will be closed on:

December 24 for Christmas

December 31 for New Year’s

Convention Winners

Congratulations to the grand prize winners of an Amazon Echo Show 5®. The following people won by registering at our convention booth. Thanks to all who stopped by our booth to register and say “Hi”. We greatly appreciate your support and participation. Remember to look for the Software Unlimited, Inc. booth at the next convention and maybe you will be the next winner!

Winner at the NDSBA Conference in Bismarck, ND

Deborah Nelson from Bottineau Public School District #1

Winner at the Wyoming Trade Fair in Casper, WY

Clint Krumm from Sheridan County School District #1

Staff Spotlight - Amy Feit

Joining Software Unlimited, Inc. in 2004, Amy has had the pleasure of working with many customers over the past 17 years and truly enjoys the relationships that have been cultivated. As the Director of Customer Support, Amy feels fortunate to work alongside so many talented and caring Customer Support Representatives who have a passion for helping our customers.

Amy recently began navigating the waters of an empty nester lifestyle after having sent her youngest of two daughters to college this past fall. She says that being an empty nester sounds good until it happens to you – ha! Filling the additional free time that comes with no longer having to run after kids is no problem though, as Amy is an avid runner, hiker, and traveler. In addition to completing her 21st marathon in early December, she and her husband, Kyle, have summited seven 14,000+ ft mountain peaks and hiked through some of the most beautiful places in the United States. She says she has some work to do on figuring out how to relax on vacations, but we don’t foresee that happening any time soon!

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Janae LaDue who is the Business Manager at Eight Mile School District #6 in Trenton, ND. We had these questions for her:

How long have you been using the School Accounting System?

• I am in my sixth year.

What module do you spend most of your time working in?

• Since I do many different tasks within the software, I work a lot in each of the three main modules: Accounts Payable, General Ledger, and Payroll.

What is your favorite feature in the School Accounting System?

• I really love the Common Tasks on the main screens. I have the Vendor Inquiry pinned that I use all the time.

What are three words you would use to describe the School Accounting System?

• Efficient, user-friendly, and I love how helpful Support is.

What is your favorite part of working at your district?

• I really love that there are so many different tasks involved with being a Business Manager. It is not monotonous or repetitive. I enjoy being a coach for Junior High Volleyball and Elementary/Junior High Basketball, as well as the Yearbook Advisor. I also love that I get to see the kids each day being part of a small district.

What are your hobbies?

• I like to spend time reading and running.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Take advantage of the webinars offered and call Support for everything! Make sure you are receiving the emails about upcoming trainings being offered, particularly webinars.

Congratulations to Juliane and Colin! Juliane, who works in our Training Department, and her husband Colin, welcomed a new baby boy to their family. Beckham Colin was born on September 20 weighing 8 pounds.

Congratulations to Juliane and Colin! Juliane, who works in our Training Department, and her husband Colin, welcomed a new baby boy to their family. Beckham Colin was born on September 20 weighing 8 pounds.