- Knowledge Base Categories:

- School Accounting System

- Payroll

Training Tidbit: Is there a way to account for employees exempt from Social Security within the Balancing Information option for Missouri and Illinois organizations?

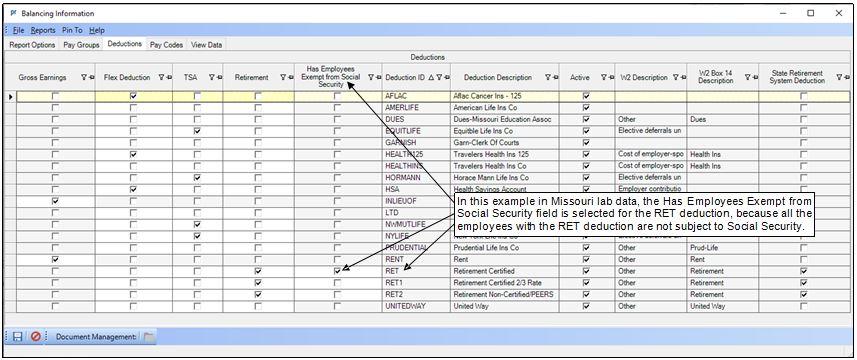

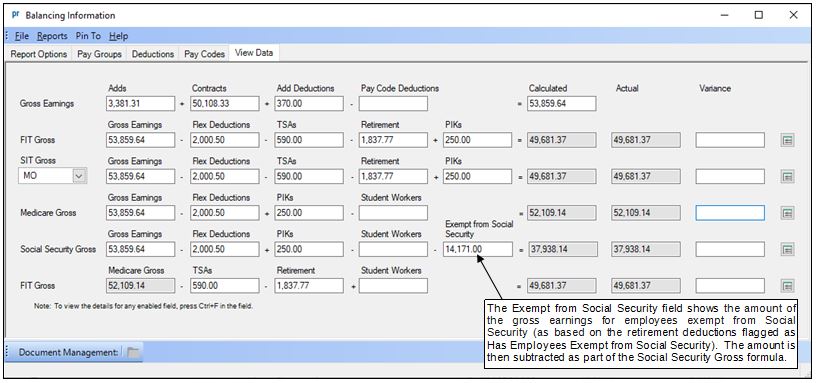

Yes, Missouri and Illinois organizations can utilize the Has Employees Exempt from Social Security field located on the Deductions tab within the Balancing Information option. The Has Employees Exempt from Social Security field is only enabled for deductions with the State Retirement System Deduction field (column) selected. Missouri and Illinois organizations should select the Has Employees Exempt from Social Security field (column) for a retirement deduction if the employees set up with that deduction are not subject to Social Security. Then when on the View Data screen, the Exempt from Social Security field in the Social Security Gross formula reflects the amount of the gross earnings for employees exempt from Social Security and the amount is subtracted from the formula.

The Has Employees Exempt from Social Security field on the Deductions screen in the Balancing Information option, and the Exempt from Social Security field in the Social Security Gross formula on the View Data tab, only appear for Illinois and Missouri organizations.

Note: If a retirement deduction is used for both employees who are not subject to Social Security and employees who are subject to Social Security, and the Has Employees Exempt from Social Security field is selected for the deduction, a variance will show for the Social Security Gross formula for those employees who are subject to Social Security. If applicable, click the Show Details button to verify the variance is the total amount of wages paid to the employees who are subject to Social Security. If desired, to avoid having a variance in the future for this scenario, copy the existing retirement deduction in order to create a new retirement deduction so that you have two, one for those employees who are not subject to Social Security and one for those employees who are subject to Social Security. Then update the Employee File to have the appropriate employees defined with the applicable retirement deduction. When completing the Balancing Information option in the future, only the one retirement deduction used for employees who are not subject to Social Security would need the Has Employees Exempt from Social Security field selected.