← Back to Newsletter Archives

December 2022 – Volume 26 Issue 4

Retirement Announcement and Vision of the Future

With careers of more than 70 years combined, it is with deeply mixed emotions that Software Unlimited, Inc. (SUI) is announcing the retirements of Tom Chaplin (co-founder) and Pam Derheim (CEO).

The SUI team shares a deep gratitude for the creation of a family-oriented culture that sees and cares for people, be they customers, vendors, colleagues, or family members. While putting people first, Tom and Pam were able to channel years of collective effort to build products and services that continue to be chosen by new and loyal customers.

Those of us who remain will strive to carry on their legacy of being excellent with people and products. Tom and Pam have been comforting voices, helpful friends, and consistent guides as SUI has navigated changes in technology, product requirements, and people. Tom and Pam are retiring on timeframes of their choosing and each have new adventures penciled on their personal calendars.

As for SUI, we’re going to continue being the consistent, trusted partner that our customers have come to expect while embracing opportunities ahead to build new products and deliver our services with the best tools available. As we look to the future, we see product enhancements that include a modernized tech “stack” that will enable an intuitive, web-based user interface as well as facilitate API integrations with complementary software applications. Our steadfast focus on modernization will allow more features to be easily accessed from anywhere, anytime on laptops, tablets, and smartphones. Through the transitions in technology, we will continue to listen closely to the generous customer feedback that has enabled us to refine and improve our products over time.

Taking over in company ownership roles are long-term employees Corey Atkinson, Amy Feit, and TJ Chaplin. Corey will continue to engage customers and partners in sales and strategy, Amy will continue to lead our service experience to help ensure customer success, and TJ will guide the product development pipeline. Although a major era at SUI has come to a close, we continue looking forward to working together and serving all of you!

Other Compensation and Payment-in-Kinds

As you know, it is important to follow the laws and guidelines set by the Internal Revenue Service (IRS) in order to avoid penalties and fines. One of the topics that we hear from time to time regarding the IRS laws and guidelines is the taxing of “other compensation”. According to the IRS, wages and other compensation are subject to federal employment taxes and are defined as the pay given to employees for services performed, which can be in cash or in other forms, including salaries, vacation allowances, bonuses, commissions, and taxable fringe benefits. Non-cash payments to employees, such as goods, lodging, food, clothing, or services, are said to be made “in kind” and generally should be taxed at the fair market value of such payments at the time they are provided.

The other forms of compensation consist of a wide variety of items, including (but not limited to) fringe benefits, wages not paid in money, and excess per diem amounts. Below are common examples of other compensation items provided by school districts that are taxable:

- Employer-paid life insurance over $50,000 of coverage

- Vehicles used for commuting

- Employer-provided cell phones

- Reimbursed meals without an overnight stay

Refer to the IRS publications noted below for additional items of other compensation subject to federal employment taxes, along with specific exemptions. If needed, contact the IRS or your auditor with questions on whether a specific type of other compensation is taxable.

Within the School Accounting System, a payment in kind (PIK) is used to tax your employees for other compensation. A PIK will increase the employee’s taxable gross wages, but will not affect the gross earnings. A PIK can be set up in Payroll as a deduction or as a pay code, depending on how it will be used. If the PIK needs to be included on an employee’s payroll earnings each pay period, then use a deduction. If the PIK needs to be included on an employee’s payroll earnings only occasionally, then use a pay code.

For detailed instructions on setting up and using payment in kinds as deductions or pay codes within the School Accounting System, click here.

Newsletter Survey

On the topic of payment in kinds: Do you use payment in kinds within the School Accounting System to tax employees for other compensation? If so, do you have PIKs set up as deductions, pay codes, or both? What types of other compensation do you tax for your employees?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

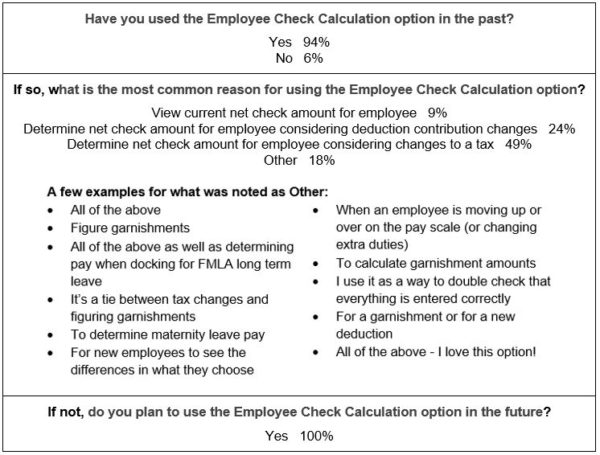

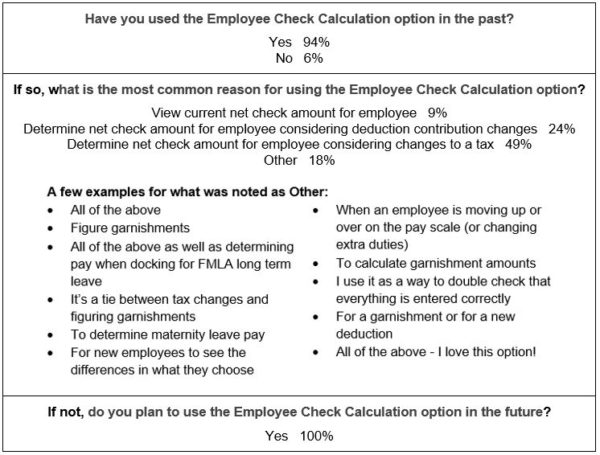

Previous Survey Results

The Newsletter Survey questions for the September 2022 issue related to the Employee Check Calculation option. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

EOCY Reminders

The end of calendar year is almost here, and it is time to begin preparing 1099s, W2s, and 1095s. As you complete the end of calendar year tasks, here are a few reminders and tips to keep in mind:

Accounts Payable:

- Use the Accounts Payable End of Calendar Year Checklist to be sure all steps are completed.

- Use the 1099-NEC forms to report nonemployee compensation payments of $600 or more to unincorporated vendors, and use the 1099-MISC forms to report payments for miscellaneous items, including rents, prizes and awards, medical and health care payments, and gross proceeds paid to an attorney.

- To add a second name for a vendor to print on the 1099 form, if needed, complete the Additional Recipient Name and Print Location fields on the Miscellaneous tab in the Vendor File.

- Deliver 1099-NEC and 1099-MISC forms to vendors by January 31.

- Submit 1099-NEC forms to the Internal Revenue Service by January 31 if filing by paper or electronically via the internet.

- Submit 1099-MISC forms to the Internal Revenue Service by February 28 if submitting by paper or March 31 if filing electronically via the internet.

Payroll:

- Use the Payroll End of Calendar Year Checklist to be sure all steps are completed.

- Allow time for your employees to review their W2s and 1095s before submitting the returns to the government.

- Deliver W2s to employees by January 31.

- Deliver 1095s to employees by March 2, if applicable.

- Submit W2s to the Social Security Administration by January 31 if filing by paper or electronically via the internet.

- Submit 1095/1094 forms electronically to the Internal Revenue Service by March 31, if applicable.

Also, remember the recordings of the end of calendar year webinars, which review all the steps on the end of calendar year checklists, can be requested from the Training Calendar on our website.

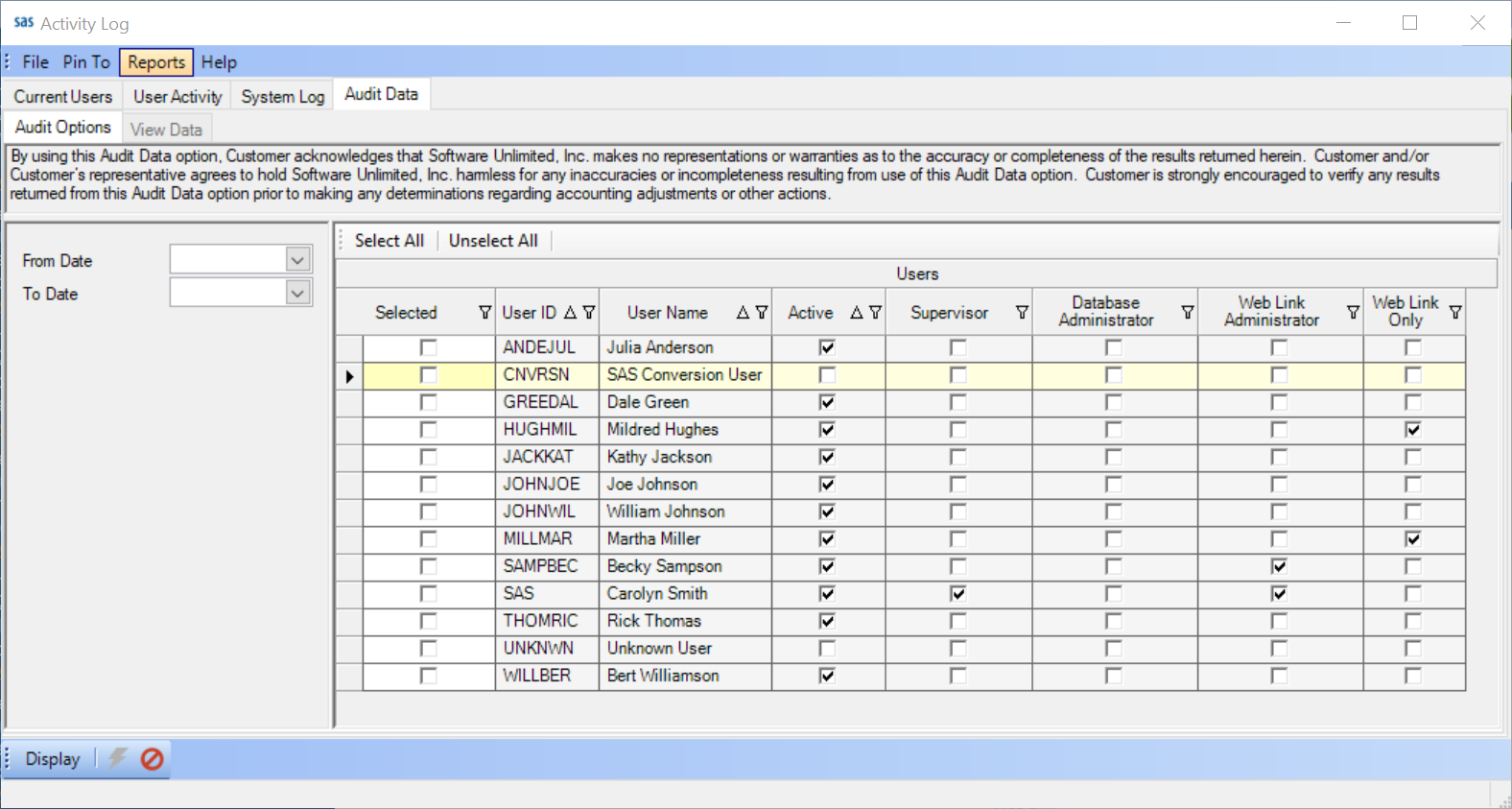

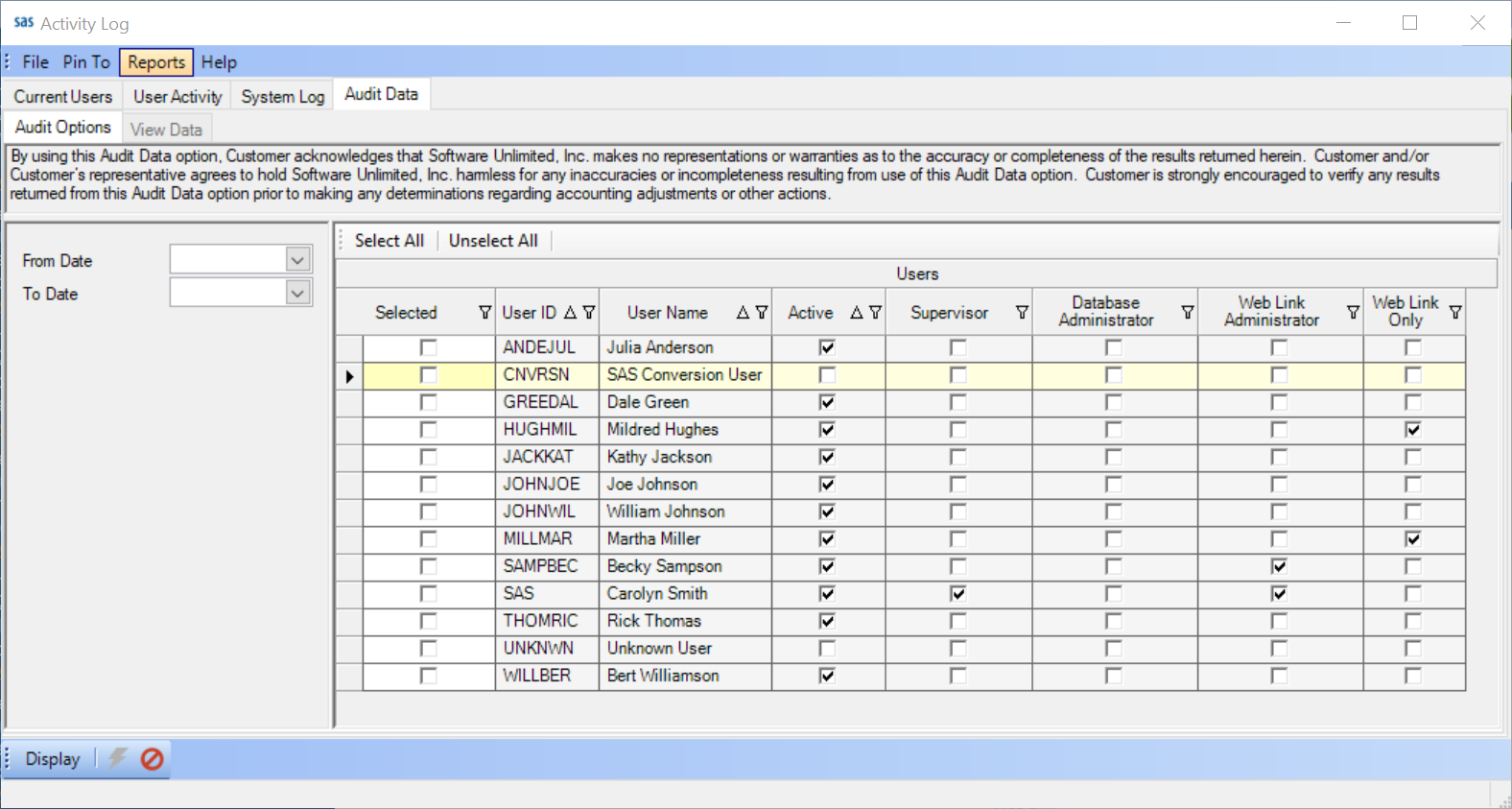

Audit Data Feature

Did you know the Audit Data tab within the Activity Log option is available in order to view audit records? Using the Audit Data tab in the Activity Log, the audit records tracked for record changes, additions, and deletions in all modules of the School Accounting System can be viewed for a particular date range for selected users.

To access the Audit Data feature, select the Activity Log option under the Utilities menu on the main screen of the School Accounting System, and then within the Activity Log option, click the Audit Data tab to start a search of audit records. When searching, specify the range of dates for which audit records to view and select the users whose changes to display. Then select which tables within the database (for the modules and options in which there were changes, additions, or deletions made within the specified date range by the selected users) to view. The results of the audit record transactions, showing the audited field along with the old and new values if applicable, will display on the screen and can be printed or exported.

For more information, refer to the Activity Log topic in the Help File, or click here to view the Audit Data Tutorial.

Support Corner - Amy Feit, Director of Customer Support

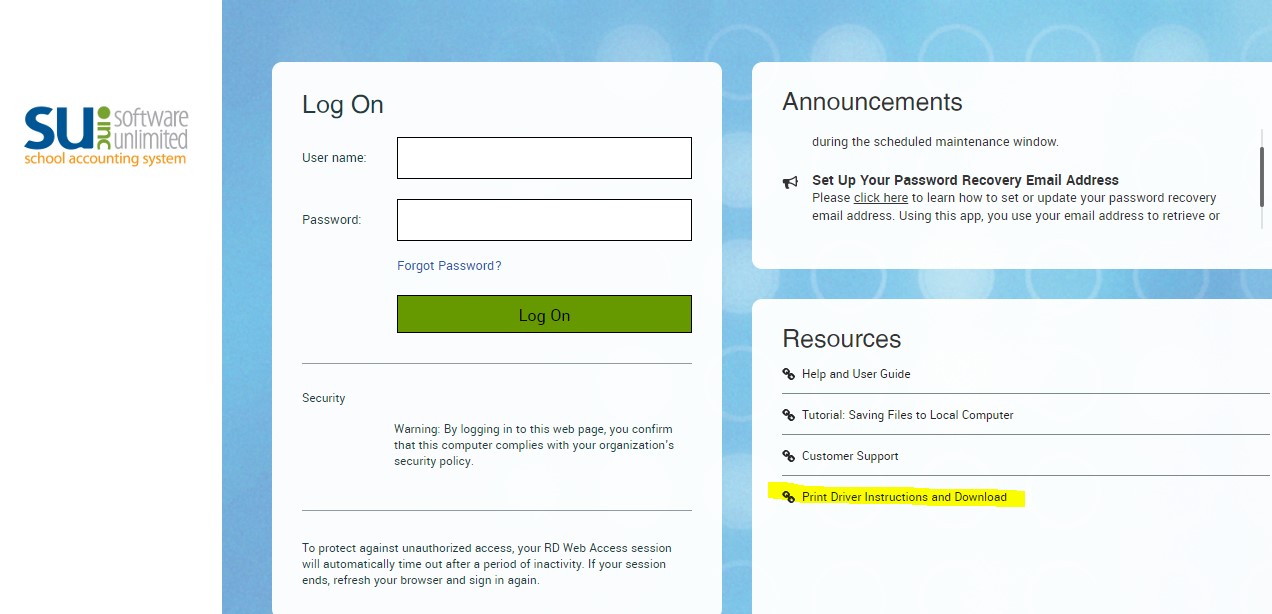

Install Print Drivers for Faster and More Reliable Printing

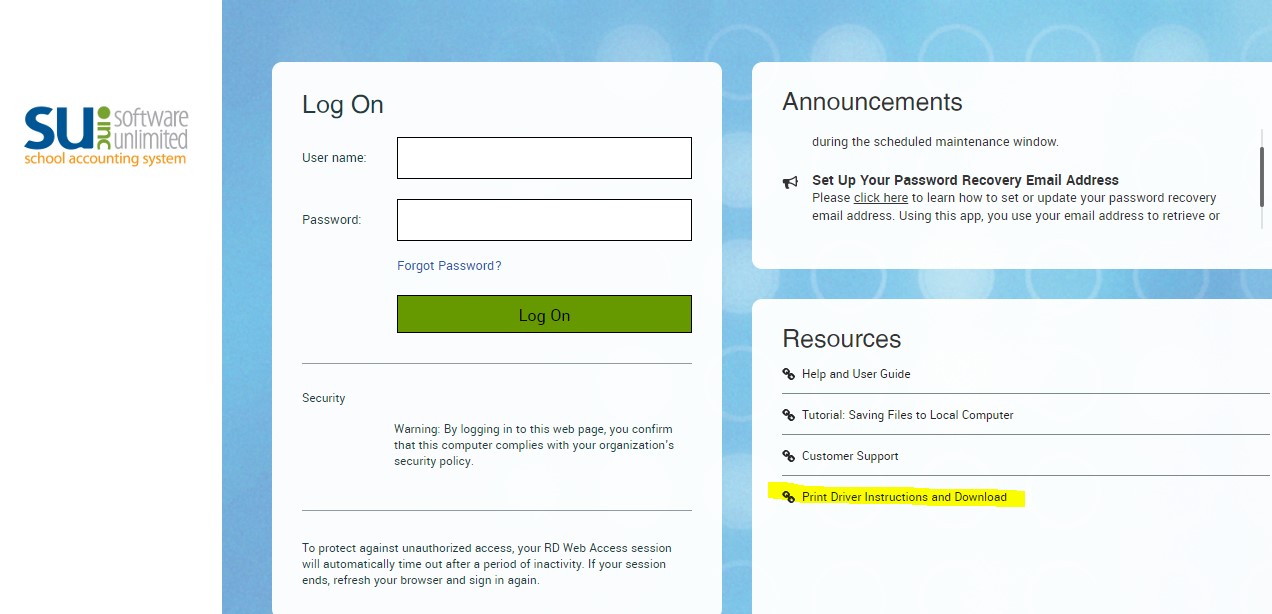

There are many reasons to appreciate our hosted option, including the convenience of having anytime, anywhere access and the peace of mind that your data is safe and secure. We hear from customers who love all the features that come with the School Accounting System-Online, but occasionally, they note report printing can sometimes be slower than expected. We have a solution!

To ensure faster and more reliable online printing on a PC, the steps to install and configure the print drivers should be taken as soon as possible. Click the following link for instructions: https://docs.su-inc.com/support/PrintScrewDrivers.pdf. Alternatively, these instructions, along with other important information, can be found in the Resources section of the School Accounting System-Online landing page:

If you are not already taking advantage of the School Accounting System-Online option and would like more information, please contact sales@su-inc.com. If you have any questions on how to install and configure the print drivers on a PC, please contact Customer Support by submitting a support request through the School Accounting System, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Thank you for your feedback!

We understand your time is valuable, and we want to help you save more of it through product and service enhancements. Please keep an eye on your inbox for opportunities to share your feedback, rate how we are doing, and suggest how we can improve.

Your comments and suggestions are crucial for future enhancements. You are truly driving the development of the School Accounting System, and ultimately, saving yourself time by making the system better for you and your colleagues.

We thank so many of you who have taken the time to share your feedback, and we look forward to hearing from you on the next survey!

Training Snippets

Each quarter the Training Snippets tutorial covers topics for new options or changes included in recent updates, along with a quick tip for an option or shortcut. The Training Snippets tutorial for December 2022 includes the following topics: new General screen, updated Create Electronic File screen, and a new field for extra spacing within Vendor 1099s and Employee W2s; Mailing Labels in Accounts Receivable; and Default Chart of Account Numbers and Distribution Percents for Received Froms used with Cash Receipts. Click here (or on the image below) to watch the 2-minute tutorial. To review all the changes and enhancements included in recent updates, click here to view the release notes.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. What is the shortcut key for the Save and Clear button? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option can be used to change the description, due date, or account number (if operating on a cash basis) for an invoice that has been posted but is not yet selected to be paid? The answer is the Vendor Inquiry option in Accounts Payable. Congratulations to Cathy Johnson from North Star Public School District #10 for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

December 26 for Christmas

January 2 for New Year’s Day

Convention Winner

Congratulations to the grand prize winner of an Amazon Echo Show®. The following person won by registering at our convention booth. Thanks to all who stopped by our booth to register and say “Hi”. We greatly appreciate your support and participation. Remember to look for the Software Unlimited, Inc. booth at the next convention and maybe you will be the next winner!

Winner at the Wyoming Trade Fair in Casper, WY

Maria Johnson from Carbon County School District #2

Staff Spotlight - Aaron Pleitez

Aaron joined the Software Unlimited, Inc. team in 2020. He currently is working as a front-end engineer contributing to the areas of research and development, and architecture planning.

Aaron and his wife Elizabeth (who also works for Software Unlimited, Inc.) work remotely from sunny southern California. When he is not at work, he loves to spend his time swimming, running, biking, and loves a good misogi challenge. If you don’t casually find him and his wife at the beach, you can catch them in the mountains or at a local coffee shop sipping on some fresh bean juice.

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Michelle Wemhoff who is the Bookkeeper at Humphrey Public School in Nebraska. We had these questions for her:

How long have you been using the School Accounting System?

• I have been using the School Accounting System since 1996 when we went from doing the books manually. It’s the only software I have ever known!

What module do you spend most of your time working in?

• Depends on the month in the year, but usually Accounts Payable.

What is your favorite feature in the School Accounting System?

• The Adjust Posted Entries option is so helpful to easily change a code.

What are three words you would use to describe the School Accounting System?

• User friendly, helpful, and reliable

What is your favorite part of working at your district?

• The students and staff. We are a K-12 district and I also operate the Hot Lunch, so I get to see them a lot. They are awesome.

What are your hobbies?

• Spending time with my one-year-old granddaughter, camping, and traveling.

If you could meet or interview one person (dead or alive), who would it be, and why?

• My mom, as she has passed away; I would ask her about recipes to “What do I do now?”.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Go to training! The three-day training that is taught shows so much more than I would be able to show anyone in a short amount of time.