← Back to Newsletter Archives

June 2018 – Volume 22 Issue 2

Are you ready for Electronic Document Management?

Are you printing documents just to store them in a file cabinet? Are file cabinets taking up important floor space? Do you spend hours looking for paper documents? What would happen to those documents if you had a fire or a flood?

As an administrator, you want to focus your time on high priority district needs. Spending your time looking for historical documents and worrying about safely and securely retaining those records should not be stressful.

An electronic document management platform, with a secure and customizable cloud-based repository, allows your organization to reduce the need for long-term paper storage and manual retention policies. With a flexible electronic filing structure, the storage, archival and retrieval of documents is easier, while complying with state mandated retention policies. Storage concerns are eliminated, IT costs are reduced, and record retention is automated.

Cloud-based solutions have come a long way in a few short years. With several major Software-as-a-Service (SaaS) providers investing heavily in cloud services and flooding the market space, it has created a very competitive environment, driving costs lower.

An electronic document management solution can help you streamline:

- Hiring of employees and teachers

The hiring process enables paperless on-boarding through intelligent workflow. Complete, review and process new employees more efficiently, ensuring that all required information is collected before an employee’s start date, while easily tracking information such as ongoing certification requirements throughout an employee’s tenure. Once all your employee records are online, you can grant employees immediate, yet secure, access to view personnel files at any time, from any device.

- Securing special needs documentation

You can keep special needs documentation such as psychological evaluations, medical records and individualized education plans, in a secure, easy to access location for those that have permission to access them. With a document management solution, it is even easier to ensure compliance with state and federal regulations.

- Integrating with administrative software

Integrate with the School Accounting System or student records solutions to further ease the access to documents related to students, Payroll, HR, AP, AR, etc., reducing the need for paper storage of documents and keeping all related documents together for better financial decisions, less paper shuffling and less manual data entry.

- Maintaining historical documents in a safe and secure location

Make sure your important employee, financial, and student records are safe from disasters, and ensure only those that require access to the files have access anytime from anywhere.

With lowered costs and increased security and reliability, cloud-based document storage solutions are becoming affordable for K-12.

Software Unlimited, Inc. will be rolling out an electronic document management solution in Fall 2018 that will integrate with the School Accounting System and add-on modules to help districts of all sizes be more efficient, and ultimately, save time and money.

Newsletter Survey

On the topic of document storage: How do you currently store documents at your school district? If you currently store paper documents, are you interested in changing to an electronic document storage system?

On the topic of document storage: How do you currently store documents at your school district? If you currently store paper documents, are you interested in changing to an electronic document storage system?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

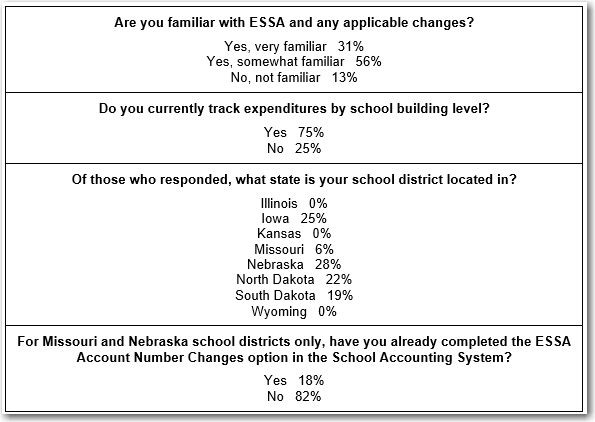

Previous Survey Results

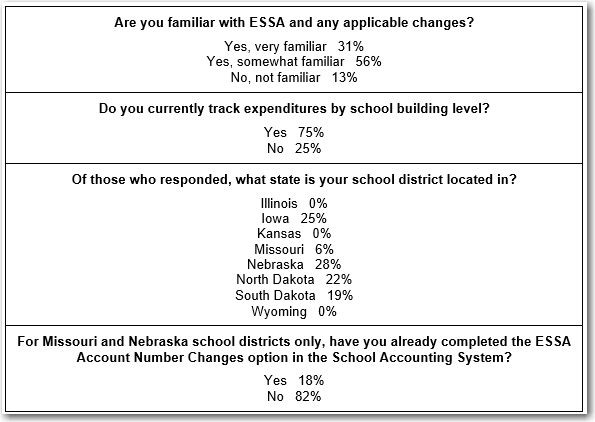

The Newsletter Survey questions for the March 2018 issue related to ESSA. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

End of Fiscal Year Reminders

With the end of fiscal year quickly approaching, keep the following items in mind when completing your end of fiscal year activities.

In Accounts Payable, there are two ways to expense payables for the end of fiscal year:

- Method 1 (new this year) – Expense invoices at the time of entry by completing the End of Fiscal Year Options section when creating an invoice batch.

- Method 2 – Expense outstanding (posted but not yet paid) invoices and/or purchase orders using the Expense Outstanding Payables option.

In Payroll, there are three ways to expense unpaid contracts and benefits for the end of fiscal year (not applicable for Nebraska school districts), along with a fourth method for pertinent Iowa school districts:

- Method 1 – Calculate and process separate payroll batches for the July and August pay cycles using Regular as the Payroll Type and June as the processing month.

- Method 2 – Calculate a payroll batch using Expense Payroll as the Payroll Type to expense the salaries (including contract balances and June hourly wages) and benefits to the current fiscal year without printing the checks.

- Method 3 – Calculate a payroll batch using Pay Off Contracts as the Payroll Type to pay salaries (including contract balances and June hourly wages) and benefits by printing the employee and payee checks separately with the same dates, separately with different dates, combined into one check per employee or company, or a combination of the above.

- Method 4 (for applicable Iowa school districts only) – Calculate a payroll batch using Reversing GAAP as the Payroll Type to reverse GAAP expense the salaries (including contract balances and June hourly wages) and benefits to the current fiscal year without printing the checks. If the salaries and benefits are reverse GAAP expensed, the totals do not post to the expenditure accounts, but are reflected on the C.A.R.

In General Ledger, there are two ways to record outstanding receivables for the end of fiscal year:

- Method 1 (new this year) – Enter outstanding receivables as cash receipts by completing the End of Fiscal Year Options section when creating a cash receipt batch; then when the money is actually received (in the next fiscal year), use the Select Receivables for Processing option to bring in the appropriate outstanding receivables.

- Method 2 – Enter outstanding receivables as manual journal entries.

The detailed instructions for completing all the above methods are listed on the following checklists, along with the other necessary steps for ending the fiscal year:

Also, remember that recordings of the end of fiscal year webinars for Accounts Payable, Payroll, General Ledger, and Fixed Asset Inventory are available; to request a recording of the end of fiscal year webinars, click here to access the Training Calendar.

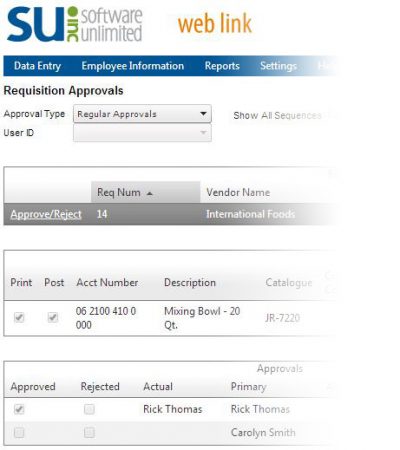

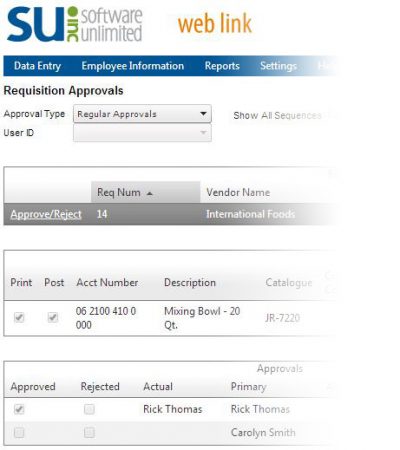

How can the Web Link module help my school?

The Web Link add-on module is quickly becoming one of the most popular add-on modules to the School Accounting System, and the module is designed as a web-integrated extension of the School Accounting System to facilitate:

- Online Requisition entry with an electronic approval process

- Online Purchase Order entry

- Online Cash Receipt entry with receipt printing

- Online Check Stub, W2, 1095, and Leave Balance information for district employees

- Online viewing and printing of School Accounting System reports for district administrators

- Online integration with the Fixed Asset Inventory module to help expedite annual room inventory process

During Summer 2017, we released a Leave Request feature that is integrated with Leave in the Payroll module, and the positive response has been wonderful.

To help ensure you are taking full advantage of the Web Link module, we invite you attend a no-cost workshop, webinar, or request a webinar recording. Visit our Training Calendar at https://www.su-inc.com/training/training-calendar/ using search key words “Web Link”.

If you are not currently licensing the module, visit the Web Link product page on our website at https://www.su-inc.com/product/web-link/ or please contact sales@su-inc.com for more information.

Support Corner - Amy Feit, Director of Customer Support

End of Fiscal Year Assistance

School is out for summer! This also means it’s the busy season for the school business office. In addition to assisting with questions you may have while completing your normal daily, weekly and monthly tasks, we are here and ready to help you navigate the unfamiliar items that come up once a year. As you have questions, please do not hesitate to contact us. Below is a reminder of the various contact methods.

Give us a Call – Simply dial 800.756.0035 and when prompted, dial extension 2 as this will get you through to a live representative. Chances are good you will get right through to a representative when calling; however, if there is not a live representative available, you will be automatically redirected to the receptionist whom will take your information and then the next available Customer Service Representative will call you back.

Submit a Question from our Website – Questions can be submitted from the Support page of our website by clicking the Email Customer Support link found on the main screens of each module throughout the School Accounting System. In addition to including a brief explanation of your question, you can also attach any supporting documentation, such as a report, while submitting your question. Click here to access the Contact Support page on our website https://www.su-inc.com/support/contact-support/.

Submit a Question by Email – Questions can be submitted by simply sending an email to Customer Support at support@su-inc.com. When emailing, be sure to include your name, school district and customer number. Similar to submitting a question on our website, you can also include attachments and a brief explanation of your question when emailing.

Microsoft Lifecycle for Products and Support

As you may already know, Microsoft® has a lifecycle policy that is used to make it clear when Microsoft will cease to provide support and service for their products. This means at the end the lifecycle there will no longer be new security updates, non-security hotfixes, free or paid assisted support options, or online technical updates.

In addition to the vulnerabilities and security risks running an unpatched operating system impose, new features implemented in the School Accounting System may no longer be compatible with systems that are no longer supported by Microsoft.

For a couple key Microsoft products many of you may still be using, the end of life cycle is within site. Both Windows 7 and Windows Server 2008 R2’s end of support dates have been published as January, 2020. This date is more than a year and a half away, yet if you are currently using one of these products, you should begin a plan to replace or upgrade in the near future.

If you have any concerns in regards to your current hardware configuration or would like to speak with someone about the system recommendations, we are more than happy to help. Please contact our Hardware Department at 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Employee/Payee Inquiry Tutorial

The Employee/Payee Inquiry option shows all payroll checks issued to a specific employee or payee. In a recent update, the Employee/Payee Inquiry option was enhanced to now include additional details for each employee check — the chart of account numbers for the pay codes are displayed along with the batch information for any pay period entries and the chart of account numbers are displayed for deductions and taxes. Click here (or on the image below) to watch a 3-minute video demonstrating the Employee/Payee Inquiry option.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. Is there a way in Accounts Payable to make multiple vendors inactive based on their last check date? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option can be used to correct or change the account numbers on posted checks in Payroll and posted checks (if operating on a cash basis) or posted invoices (if operating on an accrual basis) in Accounts Payable? The answer is the Adjust Posted Entries option accessed under the Options menu in General Ledger; and keep in mind, the Adjust Posted Entries option was also recently updated so it can now be used to correct or change the account numbers on posted cash receipts as well. Congratulations to Vicky Grothmann from Hillsboro Public School for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

July 4 for Independence Day

Convention Winners

Congratulations to the grand prize winners of an Amazon Echo Spot®. The following people won by registering at our convention booth. Thanks to all who stopped by our booth to register and say “Hi”. We greatly appreciate your support and participation. Remember to look for the Software Unlimited, Inc. booth at the next convention and maybe you will be the next winner!

Winner at the IASBO Conference in Ames, IA

Carmen Benson from Winfield Mt. Union CSD

Winner at the NASBO Conference in Lincoln, NE

Patricia Smith from Southwest Public Schools

Winner at the SDASBO Conference in Pierre, SD

Beth Feddersen from Jones County School District

Winner at the MoASBO Conference in Osage Beach, MO

Lisa Patrick from Independence School District

Staff Spotlight - Becca Hegg

Becca joined Software Unlimited in September 2017. She and her husband, Dave, enjoy spending time with their three boys Ethan (16), Jackson (14), and Seth (10). When possible, Becca also enjoys shopping and going to movies.

On the topic of document storage: How do you currently store documents at your school district? If you currently store paper documents, are you interested in changing to an electronic document storage system?

On the topic of document storage: How do you currently store documents at your school district? If you currently store paper documents, are you interested in changing to an electronic document storage system?