← Back to Newsletter Archives

September 2017 – Volume 21 Issue 3

Reporting new employees to your state is not a new requirement, but being able to create a file of your new (and rehired) employees from within the School Accounting System to upload to your state’s website is brand new! The New Hire Report is a new option available in the latest release of the School Accounting System (version 17.09.26.01 or higher), and is accessed under the Government Reporting menu in Payroll. With the New Hire Report option, all the necessary information mandated by your state to report for your new hires can be printed to a report or a file. Below are reminders for reporting new hires for the various states:

- Illinois: Report new hires within 20 calendar days of their start date, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have been separated for at least 60 consecutive days.

- Iowa: Report new hires within 15 days of the date of hire, including those individuals who have not previously been employed by the district, and those who were previously employed by the district and had a termination lasting a minimum of 6 weeks. Important Note: In order to upload a file for the new hire report on the state’s website (https://secureapp.dhs.state.ia.us/epay/default.aspx), the school district must first sign up to use the upload service and submit a test file. The steps to sign up for the upload service can be completed under the Upload New Hires section on the main menu after logging into their website. For detailed instructions on signing up for the upload service and submitting a test file, refer to the help available on their website.

- Kansas: Report new hires within 20 days of the date of hire, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have been separated for at least 60 consecutive days.

- Missouri: Report new hires within 20 calendar days of the date of hire, including those individuals who have not previously been employed by the district, and those who are returning and are required to submit a W-4 form.

- Nebraska: Report new hires within 20 days of the date of hire, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have been separated for at least 60 days.

- North Dakota: Report new hires within 20 days of the date of hire, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have been separated for at least 60 days. Important Note: In order to upload a file for the new hire report on the state’s website (http://www.nd.gov/dhs/services/childsupport/empinfo/newhire/), the school district must first sign up to use the web file transfer service. To sign up for the web file transfer service, contact the Child Support Division of the North Dakota Department of Human Services.

- South Dakota: Report new hires within 20 days of their first day of work, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have not worked or been paid for the past 30 days.

- Wyoming: Report new hires within 20 days of the date of hire, including those individuals who have not previously been employed by the district, and those who were previously employed by the district but have been separated for at least 60 consecutive days.

To view the detailed instructions on completing the New Hire Report for your state, refer to the New Hire Report topic in the Help File.

Newsletter Survey

On the topic of new hire reporting: How do you currently report your new hires to your state? Do you plan to use the New Hire Report option in Payroll to create a file to upload your new hires to your state’s website?

On the topic of new hire reporting: How do you currently report your new hires to your state? Do you plan to use the New Hire Report option in Payroll to create a file to upload your new hires to your state’s website?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

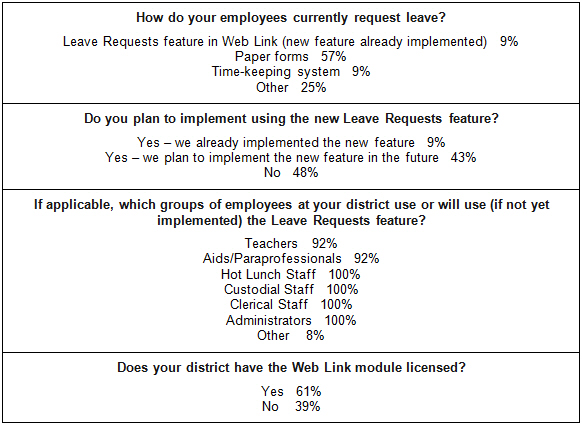

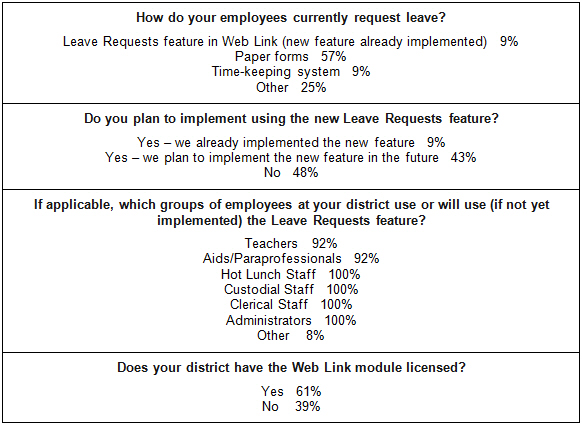

Previous Survey Results

The Newsletter Survey questions for the June 2017 issue related to leave requests. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

Custom Reports for Everyone!

The School Accounting System core program and add-on modules have hundreds of standard reports available, but we understand that districts have unique reporting needs specific to their district. Our Report Writer add-on module is a powerful information retrieval and analysis tool that many customers have licensed to help design and build custom reports.

One of the many benefits customers have enjoyed with a Report Writer module license is the ability to take advantage of Software Unlimited, Inc.’s custom report writing service when they need a report quickly and simply do not have the time to build it themselves in Report Writer.

We are excited to announce that our custom report service is now available to everyone! Additionally, we have streamlined the pricing and have moved to a simple flat rate for ANY custom report.

It’s simple. Here’s how it works:

Report Writer customers: $150 flat rate for ANY custom report

Non-Report Writer customers: $400 flat rate for ANY custom report

Bottom line, if you find your school has the need for two (2) or more custom reports per year, it is more cost effective to license the Report Writer module – plus you’ll have the added benefit and convenience of building custom reports on your own! If you find your custom reporting needs are more in the one-off category and infrequent, you now have an option available to you.

For more information or question about the custom report writing service, please contact sales@su-inc.com

Update! Purchasing Made Easy

One year ago, we introduced you to k-Purchase. Today, more than 100 districts are sharing how much they enjoy the time and money-saving benefits. In an upcoming update to our software, we are making k-Purchase an integrated part of our solution to help streamline school purchasing and administration. You will be able to access k-Purchase directly from the School Accounting System or Web Link module and start enjoying the benefits immediately.

Our favorite part – there is no-cost!

“We were quickly set up on k-Purchase and immediately completed a major purchasing project within days instead of weeks. Our staff and teachers looked at each other and said: We’re done. That’s it? It’s awesome! . . . And, we discovered over a 10% savings.”

– Paula Beyer, Central Springs District (IA)

Purchasing Made Easy includes convenient online, One-Stop Shopping, a real-live Personal Purchasing Assistant, and pricing that helps you stretch your budgets. K-Purchase can also provide a cloud-based requisition platform that streamlines the entire purchasing process, auto-fills requisitions and eliminates paperwork. Most importantly, it all works side-by-side with the SUI School Accounting System.

Stay tuned for exciting announcements coming soon!

Payroll Corrections

With a new school year, comes the first payroll with paying new employees or having existing employees who made deduction changes. All the changes and additions included in that first payroll of the year may result in a check or two, or possibly even more, that are incorrect. After a payroll has been updated, payroll corrections can be made using one or more of the following most common features:

Void Checks: Use the Void Checks option to void a check that is incorrect. A direct deposit stub or automatic payment stub can also be voided with the Void Checks option, but first contact your bank to be sure that they are able to reverse the transaction. With the Void Checks option, the original entries that were posted to General Ledger when the item was written (and updated) are reversed, and the item is marked as voided for reconciliation purposes. When voiding a payroll check or stub, the system will automatically accumulate the payables in the Deductions Payable and Taxes Payable options for all deductions and taxes which are tied to payees (the Payee ID field is completed in the Deduction or Tax File in Payroll). For details on how to void a check, click here to watch the Void Checks Tutorial, or refer to the Voiding a Check topic in the Help File.

Deduction/Tax Adjustments: If an employee’s deduction was calculated incorrectly, a simple way to correct the mistake on the next payroll is with deduction/tax adjustments. Enter a correcting adjustment into a Deduction/Tax Adjustment batch and include the batch when calculating the next payroll. Deduction/tax adjustments can be used to increase or decrease the amount calculated for a deduction or tax, issue a refund for an amount calculated for a deduction or tax, or replace and use a different amount than what is normally calculated for an employee’s deduction or tax. For detailed instructions on entering deduction/tax adjustments and to view sample adjustments, refer to the Deduction/Tax Adjustments topic in the Help File, or click here to request the recording of the most recent Deduction/Tax Adjustments webinar.

Extra Payroll: If needed, calculate and complete an extra payroll (when creating the payroll calculation batch, select Extra as the Payroll Type). Make any necessary entries in the appropriate data entry batches for inclusion in the extra payroll calculation. For example, for a contract employee, in order to pay one unit of a contract in the extra payroll, make an entry for the employee for the contract pay code with one unit in a Pay Period Entries batch.

Support Corner - Amy Feit, Director of Customer Support

Now that the beginning of the new school year has passed and the chaos that comes with the first payrolls of the year are winding down, it’s time to start thinking ahead. Before we know it, we are going to be generating employee W2s once again. Each year, our Customer Support witnesses the stress and empathizes with the frustration that comes with finding issues when balancing last minute, and we want to help you make your end of calendar year less stressful.

As you settle into routine, October and November are perfect months to work through the balancing and any necessary corrections rather than waiting until you are under the pressure of deadlines. Within the next couple of months, we encourage you to balance your W2s for a couple of main reasons:

- With the new school year, you have likely setup new deductions and pay codes. With these new items there is a higher probability for errors, so now is a great time to balance to ensure that you have setup the new items correctly.

- If you balance now, you have the opportunity to make corrections in the last quarter of the year. These corrections are much less complicated when done prior to the end of calendar year and may help you avoid having to submit W2 and 941 corrections.

The Balancing Information option found within Payroll is a great tool that can be used to assist in the W2 balancing process. Additionally, you can search the keyword “balancing” in our Knowledge Base to find more helpful information on balancing W2s and making necessary corrections.

Get started – we are here to help! Contact Customer Support at 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Credit Card Payment Batch Video Tutorial

The Credit Card Payment Batch option can be used for a batch of invoices in Accounts Payable in order to write one check or automatic payment stub to a credit card company for payment (for example, to write a check to Visa for payment on a credit card). When creating a new invoice batch, complete the Credit Card Payment Batch section, and then enter each transaction or charge as a prepaid check or automatic payment within the batch. Click here (or on the image below) to watch a 6-minute video demonstrating the Credit Card Payment Batch option.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. What option can be used to make a one-time adjustment to an employee’s deduction or tax in a Payroll check cycle? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, Where can you access an archive of all Frequently Asked Questions and Training Tidbits? The answer is the Knowledge Base on our website, which can be accessed under the Support or Training menu on the home screen of our website, or by clicking the Knowledge Base link under the Help & Support section on one of the main screens in the School Accounting System. Congratulations to Elaine Lietz from Carroll Community School District for being selected at random from the list of correct respondents and winning a USB flash drive.

Baby Block

Congratulations to Laura and Ryan! Laura, who works in our Development Department, and her husband Ryan, welcomed a new baby girl to their family. Emma Jane was born on June 26 at 9:52 a.m. weighing 7 pounds 8 ounces. Emma has a big brother – Andrew (2).

Congratulations to Laura and Ryan! Laura, who works in our Development Department, and her husband Ryan, welcomed a new baby girl to their family. Emma Jane was born on June 26 at 9:52 a.m. weighing 7 pounds 8 ounces. Emma has a big brother – Andrew (2).

Congratulations to Kim and Vinny! Kim, who also works in our Development Department, and her husband Vinny, welcomed a new baby boy to their family. Camden Richard was born on June 26 at 4:46 p.m. weighing 7 pounds 5 ounces. Camden has two big brothers – Keegan (11) and Easton (4).

Closures

Software Unlimited, Inc. will be closed on:

November 23 and 24 for Thanksgiving

Staff Spotlight - Lee Marotz

Lee joined Software Unlimited, Inc., in June of 2011 as a Support Representative. In February of 2017, he transitioned to his role as Information Technology Analyst. Lee’s free time is spent with his wife Kristyn and daughter Isabella (5). Lee is a big sports fan and enjoys attending and watching sports whenever he can.

On the topic of new hire reporting: How do you currently report your new hires to your state? Do you plan to use the New Hire Report option in Payroll to create a file to upload your new hires to your state’s website?

On the topic of new hire reporting: How do you currently report your new hires to your state? Do you plan to use the New Hire Report option in Payroll to create a file to upload your new hires to your state’s website?

Congratulations to Laura and Ryan! Laura, who works in our Development Department, and her husband Ryan, welcomed a new baby girl to their family. Emma Jane was born on June 26 at 9:52 a.m. weighing 7 pounds 8 ounces. Emma has a big brother – Andrew (2).

Congratulations to Laura and Ryan! Laura, who works in our Development Department, and her husband Ryan, welcomed a new baby girl to their family. Emma Jane was born on June 26 at 9:52 a.m. weighing 7 pounds 8 ounces. Emma has a big brother – Andrew (2).