- Knowledge Base Categories:

- Payroll

FAQ: For Missouri, how do I make deduction/tax adjustments if I set up the wrong retirement deduction for an employee?

Below are two common scenarios and the steps for resolution when corrections must be completed if the wrong retirement deduction was setup and processed for an employee:

Scenario 1: After setting up and processing PEERS (and Social Security) for an employee, I found out the employee was certified and needed to have PSRS instead (and no Social Security); how do I fix this?

• On the Deduction screen in the Employee File, add the correct retirement deduction for PSRS for the employee.

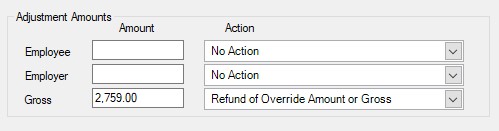

• Complete a deduction/tax adjustment to refund the gross amount for PEERS as shown below, using $2,759 as the gross:

The above deduction/tax adjustment will pay back the employee and employer at the applicable rates on the $2,759 gross, and zero the PEERS retirement gross wages for the employee.

• Complete a deduction/tax adjustment to increase the gross amount for PSRS as shown below:

The above deduction/tax adjustment will add the $2,759 to the next payroll’s retirement gross; the employee and employer contributions will then be calculated on the combined retirement gross for PSRS.

• Complete a deduction/tax adjustment to refund the gross amount for Social Security as shown below, using $2,500 as the gross:

The above deduction/tax adjustment will pay back the employee and employer for Social Security on the $2,500 gross, and zero the Social Security gross wages for the employee. (Note: The difference of $259 between the Social Security gross and retirement gross in the above examples is the amount the board pays for health insurance for the employee, which increases the retirement gross.)

• In the next payroll, make sure to select the deduction/tax adjustment batch.

Tip: Also verify that any new wages paid to the employee in the next payroll are not cross referenced to PEERS or Social Security.

• After the deduction/tax adjustments have been processed, inactivate the deduction for PEERS for the employee on the Deductions screen in the Employee File, and inactivate the Social Security tax on the Taxes screen.

Scenario 2: An employee was setup with PSRS and a payroll had been calculated, but the employee did not get certification and so PSRS must be refunded and PEERS processed instead (and Social Security also processed); how do I fix this?

• On the Deduction screen in the Employee File, add the correct retirement deduction for PEERS for the employee, and add the Social Security tax on the Taxes screen.

• Complete a deduction/tax adjustment to refund the gross amount for PSRS as shown below, using $2,759 as the gross:

The above deduction/tax adjustment will pay back the employee and employer at the applicable rates on the $2,759 gross, and zero the PSRS retirement gross wages for the employee.

• Complete a deduction/tax adjustment to increase the gross amount for PEERS:

The above deduction/tax adjustment will add the $2,759 to the retirement gross; the employee and employer contributions will then be calculated on the increased retirement gross for PEERS.

• Complete a deduction/tax adjustment to increase the gross amount for Social Security as shown below, using $2,500 as the gross:

The above deduction/tax adjustment will add the $2,500 to the Social Security gross; the employee and employer contributions for Social Security will then be calculated on the increased gross. (Note: The difference of $259 between the Social Security gross and retirement gross in the above examples is the amount the board pays for health insurance for the employee, which increases the retirement gross.)

• Calculate an Extra Payroll making sure to select the deduction/tax adjustment batch (or in the next payroll, make sure to select the deduction/tax adjustment batch).

Tip: Also verify that any new wages paid to the employee in the next payroll are not cross referenced to PSRS and are cross referenced to PEERS and Social Security.

• After the deduction/tax adjustment has been processed, inactivate the deduction for PSRS for the employee on the Deductions screen in the Employee File.