← Back to Newsletter Archives

September 2022 – Volume 26 Issue 3

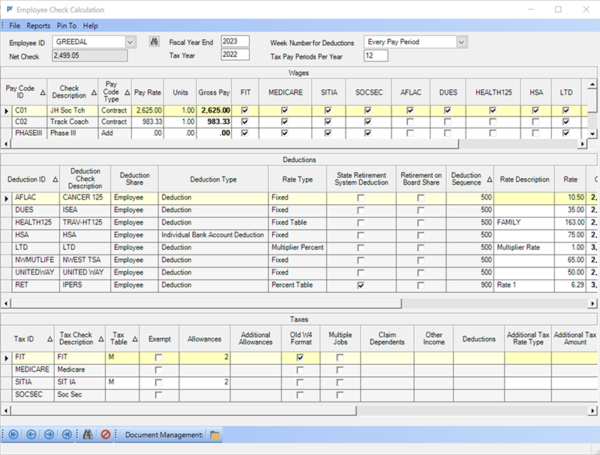

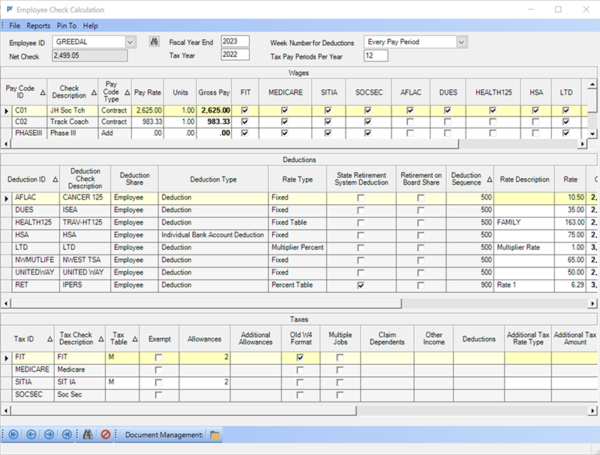

Do you have employees asking what their net check amount will be? Or employees wondering how a change to their tax exemptions or a contribution increase to a tax-sheltered annuity will affect their net check? If so, utilize the Employee Check Calculation option in Payroll to complete a simple payroll calculation to find the answers to their questions. By using the Employee Check Calculation option, the net check amount for an employee can be quickly determined, and changes can be made to calculate different scenarios to view the changes to the net check without updating their current setup in the Employee File. If after completing the Employee Check Calculation option, an employee does want to proceed with making a change permanent, then the Employee File would need to be updated at that time.

For detailed instructions on using the Employee Check Calculation option, refer to the Completing an Employee Check Calculation topic in the Help File, or to view a tutorial on the Employee Check Calculation option, click here.

Newsletter Survey

On the topic of the Employee Check Calculation option: Have you used the Employee Check Calculation option in the past? If so, what is the most common reason for using the Employee Check Calculation option? If not, do you plan to use the Employee Check Calculation option in the future?

On the topic of the Employee Check Calculation option: Have you used the Employee Check Calculation option in the past? If so, what is the most common reason for using the Employee Check Calculation option? If not, do you plan to use the Employee Check Calculation option in the future?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

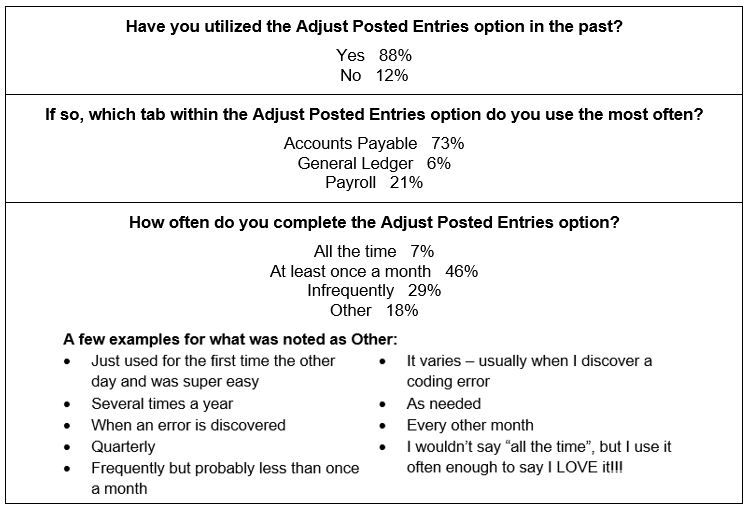

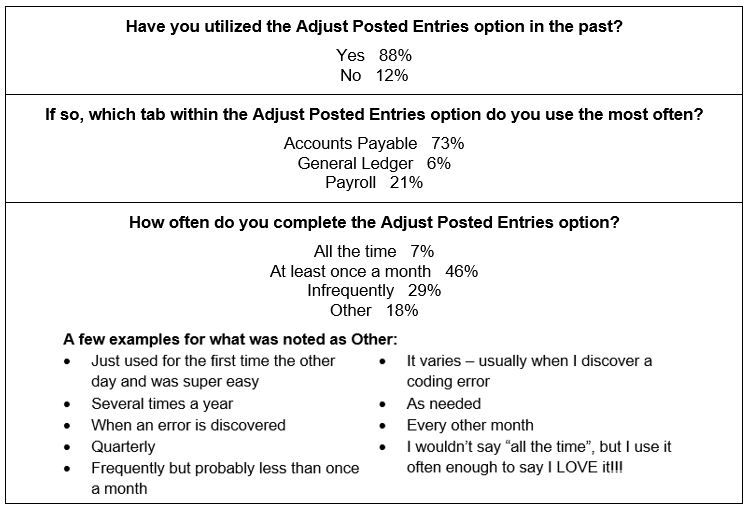

The Newsletter Survey questions for the June 2022 issue related to the Adjust Posted Entries option. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

Auditors as Users

These days everyone likes to have information instantly available, and the easier it is to access, the better it is. Recently, there has been an influx in requests that even auditors are wanting to have access to a school district’s data in order to run reports or view documents on their own. There are ways to easily accommodate these requests for your auditor — below are a few common options.

For districts with the Web Link module licensed, a user for the auditor can be defined within the User Security option in the School Accounting System with access to only print reports in Web Link. When adding the user for the auditor, specify Full Access to only Web Link and then change the rights to the options within Web Link to be No Access, and select the applicable reports on the Reports tab that the auditor should be able to generate. For districts with K12Docs, also complete the Document Management User ID field on the General tab with the auditor’s K12Docs user ID (see below regarding setting up the auditor as a K12Docs user). Then the auditor will be able to log into Web Link, print the designated reports, and click the link to open K12Docs if applicable. To view a sample Web Link user setup for an auditor, click here; and for detailed instructions on adding a user in the School Accounting System, refer to the Adding a User topic in the Help File.

For districts with K12Docs, a K12Docs user can also be defined for the auditor. When adding the user for the auditor within the Host Site Manager application, assign the user to the SUI_All_Read_Only_Access role. The auditor will then be able to log into K12Docs and search for documents in all applications (and all the folders and subfolders within the applications), and view and print documents as needed. To view a sample K12Docs user setup for an auditor, click here; and for detailed instructions on adding a K12Docs user in Host Site Manager, click here. To view a tutorial on adding a K12Docs user, click here.

For districts with the School Accounting System-Online version, a seat for an additional online user can be added for the auditor. And then the additional user for the auditor can be setup with read-only rights to access the School Accounting System. Depending on the tier and the number of seats a district currently has for online users, this option might be an additional cost; for more information on this option, contact Customer Support at support@su-inc.com.

Document Indexing in K12Docs

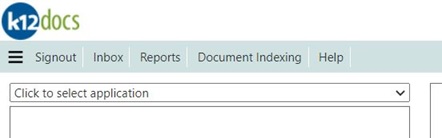

For those organizations with K12Docs licensed, documents scanned in batches to a list can be indexed from within K12Docs by clicking the Document Indexing button located on the top of the main K12Docs screen (see below). The K12Docs Indexing Hub screen will then open in order to select the application for which to index and file documents.

For step-by-step instructions to index documents from lists in K12Docs, click here, or to view the Indexing Documents from Lists in K12Docs Tutorial, click here.

As a reminder, if desired, documents scanned in batches to lists can also be indexed from within GX. If GX is utilized instead, be sure certain indexing options are selected within GX in order to make the process more efficient; click here to view the applicable Training Tidbit on this topic.

Support Corner - Amy Feit, Director of Customer Support

Securing Your Data

Is your data secure? If you haven’t been asking this question about the various applications in your district, you should be! Not only do these applications house sensitive data, but they are also most likely to be crucial to daily operations for your school district. Experiencing a breach and having your sensitive information held for ransom would have a significant impact on every person in the organization.

There are many measures that should be taken to protect your data. If your district is not using our online option, you should check with your technology coordinator to ensure that the appropriate measures are being taken. If it is not possible for your district to secure your data appropriately, the School Accounting System (SAS)-Online version is a great option to ensure the safety and security of your data.

For our customers that are currently running the SAS-Online version, here are some of the security measures currently in place and available to help you rest easy that your data is protected:

- Our data management partner provides the highest level of security, availability, processing integrity, confidentiality, and privacy in our Tier 3 data center. More information can be reviewed in the current SOC2 Report found here.

- We require a dual login process to gain access to SAS. Not only do users need credentials to get into SAS, but they also need a separate set of credentials to access the online environment to launch SAS.

- In addition to the dual login process, if you want to add an additional layer of security, or if your insurance company requires it, Multi-Factor Authentication (MFA) can be enabled. MFA is a process in which users are prompted during the sign-in process for an additional form of identification via an authenticator application.

- Nightly backups are made, and redundancies of those backups are in place.

- Any user account that has not been accessed within the last 24-months will be automatically disabled for security purposes.

If you are not already on our SAS-Online version and would like more information, please contact sales@su-inc.com. If you have any questions on the security measures in place, please contact Customer Support by submitting a support request through SAS, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Schools - Targets of Cyber-Attacks

More public agencies are reporting ransomware and malicious cyber-attacks. Unfortunately, hackers know limited budgets equal limited technological infrastructure and have been targeting municipalities and school districts with increased frequency. EducationWeek published an article with a good explanation of ‘why’ schools have become low hanging fruit for the nefarious.

Several school districts around the country have recently been hit by ransomware attacks that have crippled their organizations, and the US government warns ransomware attacks on schools may increase, according to reporting this month from CNN. Are you prepared for such an event?

Ready.gov had a trove of valuable resources, including guidance on a Business Continuity Plan to help ensure your organization is braced for uncertainty. One of the main points to understand in our modern world is the impact on Information Technology. We rely heavily on computer hardware and software; are you prepared should these fundamental assets be disrupted?

With increasing hardware replacement and maintenance costs, schools are looking for ways to securely offload their hardware responsibility. The School Accounting System-Online option is a completely cloud-based solution that offers you online access to the School Accounting System. The software is hosted on secured servers with multiple redundancies to ensure the safety of your data.

Case Study:

How the School Accounting System-Online Option Helped the Yankton School District Avert Disaster

In early May 2019, the Yankton School District (Yankton, SD) was the target of cyber incursion. While the district continues to recover, many within the district know the situation could have been much worse.

Jason Bietz, Business Manager, noted, “Many files on our network have been lost and will likely never be recovered. Luckily for finance operations at the district, all of our accounting and payroll information is in the cloud and was protected from the network breach.” Click here to read the case study.

If you would like more information on the School Accounting System-Online option and if it will be a good fit for your organization, please contact sales@su-inc.com.

End of Calendar Year Training Dates Set

All the training dates for reviewing the end of calendar year processes in Payroll and Accounts Payable for 2022 have been added to the Training Calendar on our website. We strongly recommend both new and experienced users register to attend an end of calendar year workshop or the applicable end of calendar year webinars.

During the end of calendar year trainings, we review the end of calendar year checklists for Payroll and Accounts Payable, including the steps to generate, print, email, and submit 1099-MISC and 1099-NEC forms in Accounts Payable, and W2, 1095, and 1094 forms in Payroll. Click here to view the Training Calendar and register for a training today!

Training Snippets

Each quarter the Training Snippets tutorial covers topics for new options or changes included in recent updates, along with a quick tip for an option or shortcut. The Training Snippets tutorial for September 2022 includes the following topics: the Benefit Management Export – Census Information and Benefit Management – Export Deduction Information reports, Missouri GASB 68 option, Audit Data in the Activity Log option, and editing the Common Tasks List. Click here (or on the image below) to watch the 3-minute tutorial. To review all the changes and enhancements included in recent updates, click here to view the release notes.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. What option can be used to change the description, due date, or account number (if operating on a cash basis) for an invoice that has been posted but is not yet selected to be paid? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, What option is used to create the new year for leaves in Payroll? The answer is the Adjust Leave Balances option, which is accessed under the Options menu from within the Employee File in Payroll. Congratulations to Carla Christensen from Audubon Community School District for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

November 24 and 25 for Thanksgiving

Staff Spotlight - Chris Donovan

I started working in the Customer Support Department in 2022. I enjoy learning new things in the software, especially when the customer and I learn it together and can make a connection over it. Outside of work on nice days you’ll find me out taking long walks enjoying the weather. I also enjoy reading, painting, and playing basketball in my free time.

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Amber Dye who works in Payroll and Human Resources at Fremont County School District #24 in Shoshoni, WY. We had these questions for her:

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Amber Dye who works in Payroll and Human Resources at Fremont County School District #24 in Shoshoni, WY. We had these questions for her:

How long have you been using the School Accounting System?

• I’ve been at the district for 10 years. I started out working in Accounts Payable and have recently transitioned to Payroll/Human Resources.

What module do you spend most of your time working in?

• Payroll

What is your favorite feature in the School Accounting System?

• The Request Support feature

What are three words you would use to describe the School Accounting System?

• Detailed, user friendly, and efficient

What is your favorite part of working at your district?

• We are a family.

What are your hobbies?

• Spending time with my family. I have a 6 year old and 1 1/2 year old that keep me busy.

If you could meet or interview one person (dead or alive), who would it be, and why?

• Betty White because who doesn’t love Betty White!

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Go to the training! I’ve been here 10 years and just went to my first in-person Software Unlimited, Inc. training this past April and I wish I would have gone a long time ago!

On the topic of the Employee Check Calculation option: Have you used the Employee Check Calculation option in the past? If so, what is the most common reason for using the Employee Check Calculation option? If not, do you plan to use the Employee Check Calculation option in the future?

On the topic of the Employee Check Calculation option: Have you used the Employee Check Calculation option in the past? If so, what is the most common reason for using the Employee Check Calculation option? If not, do you plan to use the Employee Check Calculation option in the future?

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Amber Dye who works in Payroll and Human Resources at Fremont County School District #24 in Shoshoni, WY. We had these questions for her:

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Amber Dye who works in Payroll and Human Resources at Fremont County School District #24 in Shoshoni, WY. We had these questions for her: