- Knowledge Base Categories:

- School Accounting System

- Payroll

FAQ: How do I enter the new rates for my insurance deduction?

If the deduction amounts for your insurance are set up in a rate table in the Deduction File, complete the following steps to update the rates on the table:

- From the Payroll screen, select the Maintenance menu and then Deductions.

- Bring up the deduction to edit by entering the ID in the Deduction ID field, or clicking the down-arrow button or the Find button to select the correct one.

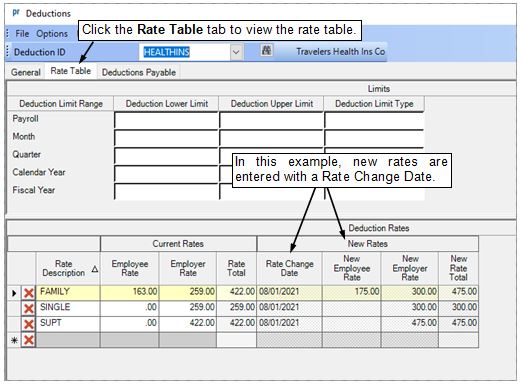

- Click the Rate Table tab.

- Make the desired changes to the deduction rates. If the new rates for the deduction take effect immediately, key in the new rates over the top of the existing rates (on the left side of the screen). Otherwise, if the new rates will change on a certain date (do not change immediately), enter the date the new rates are effective in the Rate Change Date field, and then key the new amounts in the New Employee Rate field and the New Employer Rate field. (Note: If new rates are entered with a Rate Change Date, once a payroll calculation batch is processed using a Check Date on or after the date entered in the Rate Change Date field, the new rates for the deduction will be used.)

- After all the changes have been made, click the Save button.

If the deduction amounts for your insurance are entered individually for each employee in the Employee File (the deduction is not set up with a rate table), complete the following to manually change the rates for each employee:

- From the Payroll screen, select the Maintenance menu and then Employees.

- Bring up the desired employee to edit by entering the ID in the Employee ID field, or clicking the down-arrow button or the Find button to select the correct one.

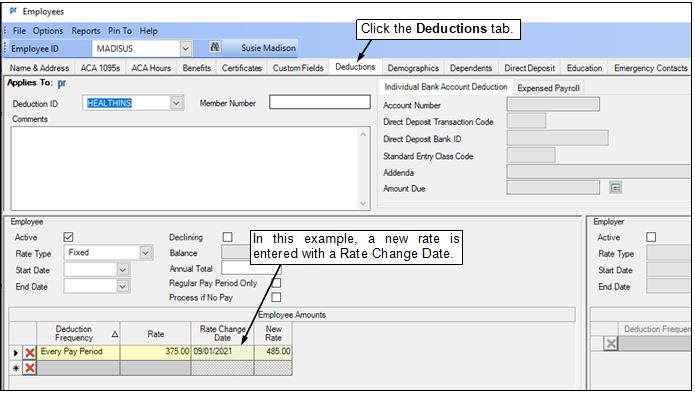

- Click the Deductions tab.

- Bring up the deduction to edit by entering the ID in the Deduction ID field, clicking the down-arrow button for the Deduction ID field to select the correct one, or double-clicking the deduction in the Employee Deductions List in the lower left corner of the screen.

- Make the desired changes to the employee and/or employer amounts. If the new rate takes effect immediately, key in the new rate over the top of the existing rate (on the left in the Rate field). Otherwise, if the new rate will change on a certain date (does not change immediately), enter the date the new rate is effective in the Rate Change Date field, and then key the new amount in the New Rate field. (Note: If a new rate is entered with a Rate Change Date, once a payroll calculation batch is processed using a Check Date on or after the date entered in the Rate Change Date field, the new rate for the deduction will be used.)

- Click the Save button to save the changes.