- Knowledge Base Categories:

- School Accounting System

- Payroll

FAQ: How do I pay an employee for sick/family leave wages that fall under the Families First Coronavirus Response Act?

Complete the steps below to pay an employee for sick/family leave wages that fall under the Families First Coronavirus Response Act:

- Set up a separate pay code to use to pay the applicable sick/family wages. When creating the pay code, select Add as the Pay Code Type, enter 14 in the Federal Form Box ID field, and use the correct expense account numbers as provided by your state.

- Using the new pay code set up in the prior step, make the necessary entries in the Pay Period Entries or Employee Absences option to the pay the employee.

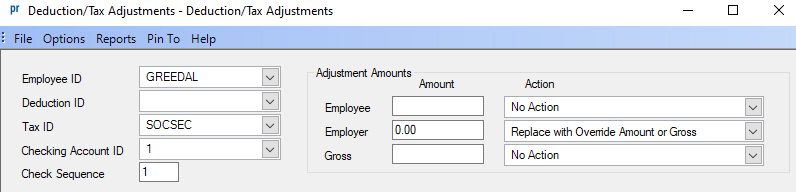

- If your organization is an eligible employer per the Families First Coronavirus Response Act and are entitled to the tax credit where you are not subject to the employer’s share of the Social Security tax imposed on the wages paid for sick and family leave, complete deduction/tax adjustments for the Employer share of Social Security. If all the wages being paid to an employee during the payroll are subject to the credit, complete a deduction/tax adjustment for the Employer share by entering 0 as the Amount and selecting Replace with Override Amount or Gross as the Action (see diagram below). Otherwise, if only a portion of the wages being paid to an employee during the payroll are subject to the credit, enter the amount of the employer’s portion of Social Security to be credited as the Amount and then select Decrease Amount or Gross as the Action.

- If desired, to view the employee and employer amounts of Social Security, generate the Deduction Register by Deduction by selecting the Social Security tax for the Deduction ID parameter and entering the applicable months in the Processing Month parameter.

- When generating the Quarterly 941, manually edit the 941 to account for the deferred amounts of the employer share of Social Security on the correct line(s). (Note: The Internal Revenue Service is updating the 941 effective for the third quarter of 2020, and once the changes are finalized, the 941 changes will be made in the School Accounting System.)