- Knowledge Base Categories:

- School Accounting System

- Payroll

FAQ: I received an error in Payroll for a deduction/tax expense account number that is not in the Chart of Accounts; how do I fix this?

The error message appears during a Payroll calculation to indicate that an expense account number for a deduction (or tax) for an employee is not defined in the Chart of Accounts File.

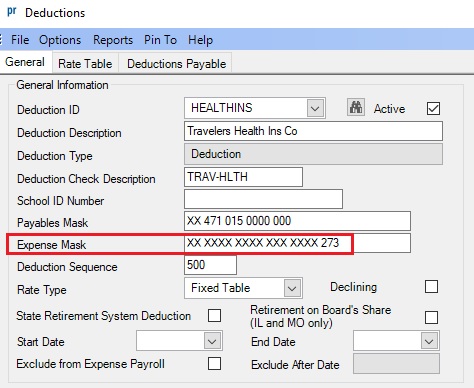

As a reminder, if a deduction (or tax) has part paid by the employer, the mask for the expenditure account to be debited for the employer’s share of the deduction (or tax) is entered in the Expense Mask field within the Deduction File (or Tax File); then when the employer’s share of the deduction is expensed during a check cycle, the placeholders for the mask will be replaced with the valid account dimensions from the salary expense accounts defined for the employees. For example, using Iowa lab data, if health insurance has part paid by the employer, the mask of XX XXXX XXXX XXX XXXX 273 is entered in the Expense Mask field within the Deduction File (see diagram below); then when an employee who has the health insurance deduction is being paid using a pay code with a salary expense account of 10 0409 1000 100 0000 120, the employer’s share of the health insurance would be expensed to 10 0409 1000 100 0000 273. And if that deduction expense account number (in this example, 10 0409 1000 100 0000 273) is not defined in the Chart of Accounts File, the error message “Account Number ##### for Deduction/Tax Expense is Not in Chart of Accounts” appears when calculating the payroll and must be resolved.

To correct this error, complete one of the following:

- Add the expense account number to the Chart of Accounts File if it is a valid account number to use, and then recalculate.

- If the expense account number is not correct, either: a) change the appropriate salary expense account number for the employee (on the Wages screen in the Employee File and in the data entry batch if a unit employee), and recalculate; or b) change the mask in the Expense Mask field for the deduction in the Deduction File (or for the tax in the Tax File), and then recalculate.

- If the deduction (or tax) should not be charged to the expense account number, change the cross references for the pay code that is associated with the account number for the employee (on the Wages screen in the Employee File and in the data entry batch if a unit employee), and then recalculate. For example, if the deduction (or tax) should not be applicable to a certain pay code, remove the cross reference for the deduction (or tax) on the Wages screen in the Employee for the applicable pay code and then recalculate.

Note: There are different errors pertaining to invalid account numbers that may also appear when calculating payroll; refer to the Payroll Messages topic in the Help File to locate other error messages and the instructions to resolve them.