- Knowledge Base Categories:

- School Accounting System

- Payroll

- End of Calendar Year

Training Tidbit: What is the Large Employer Calculation option in Payroll?

The Large Employer Calculation option in Payroll is used to help determine if your organization is an applicable large employer for the Affordable Care Act. The Large Employer Calculation option is designed to be used by those organizations who are unsure if they are a large employer. If you have already determined you are an applicable large employer, you do not need to utilize the Large Employer Calculation option, as the data generated within this option is not used with the ACA employer reporting process for completing the 1095 and 1094 forms.

An applicable large employer is defined within the ACA guidelines as an employer that has at least 50 full-time employees, including full-time equivalent employees, on average during the prior calendar year. To determine if an organization is considered an applicable large employer, the number of full-time employees and the number of full-time equivalent employees for each month in the prior year are added together and divided by 12. Full-time employees are those with an average of 30 or more hours of service per week during the month or 130 or more hours of service during the month. Full-time equivalent employees are calculated by combining the number of hours of service of all non-full-time employees for the month (up to 120 hours of service per employee) and then dividing the total by 120. For additional details on determining applicable large employer status, go to: http://www.irs.gov/Affordable-Care-Act/Employers/Determining-if-an-Employer-is-an-Applicable-Large-Employer.

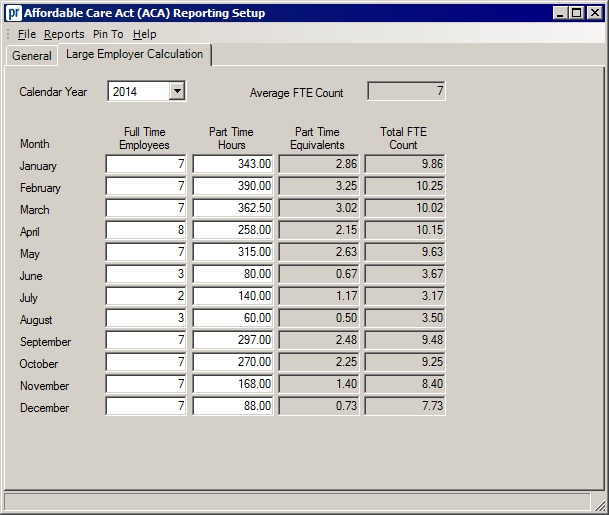

The Large Employer Calculation option in Payroll uses the calculations as outlined within the ACA guidelines (above) to compute the total number of full-time employees in each month (based on 130 or more hours of service in the month), the total hours worked by part-time employees, the total number of full-time equivalents (based on the hours worked by the part-time employees), the total FTE count for each month, and an overall FTE count for the selected year. To access the Large Employer Calculation option, select the Maintenance menu from the Payroll screen, Affordable Care Act (ACA) Reporting Setup, and then click the Large Employer Calculation tab. An image of the Large Employer Calculation tab is shown below.

Important: The Large Employer Calculation option can only be used if the hours worked have been tracked for all employees for the prior calendar year (for example, the hours worked must be tracked for all of 2022 for all employees when determining the large employer status for 2023). The Large Employer Calculation option strictly looks at the hours worked for employees and does not take into account if the Report as Full Time field is selected on the ACA Hours tab in the Employee File.

For step-by-step instructions on using the Large Employer Calculation option, refer to the Completing the Affordable Care Act (ACA) Reporting Setup Option topic in the Help File.