← Back to Newsletter Archives

December 2024 – Volume 28 Issue 4

There are ways to help increase protection and security of sensitive data within the School Accounting System. One of the simplest ways is to define the password policy for your School Accounting System and Web Link users. Ensuring users have strong passwords is important. When defining the password policy for your School Accounting System and Web Link users, you are able to set the frequency when passwords must be changed, and the complexity of the passwords, such as requiring uppercase and lowercase letters, special characters, and/or numbers, along with setting the minimum length. To set the password complexity and policy, select the Maintenance menu on the main School Accounting System screen, select System File, and then click the Password Policy tab (must be a supervisor or database administrator to access the Password Policy tab). For additional information on creating and using strong passwords, click here to view an article published by Microsoft®.

Another way to help increase protection and security is to set up multi-factor authentication. Multi-factor authentication is a validation method that requires a user to provide two or more verification factors to log into an application or account. Multi-factor authentication can be enabled and used with the School Accounting System-Online version, Web Link, and K12Docs. For more information on setting up multi-factor authentication for one or more of these applications, click the appropriate link below:

Finally, one additional option is to password protect direct deposit stubs emailed in Payroll, and password protect reports containing employee information emailed from within Payroll, Human Resources, and Negotiations. To password protect Payroll direct deposit stubs and employee reports, select the Maintenance menu from the main School Accounting System screen, select Email Manager, click the Payroll tab, and select the Password Protect Direct Deposit Stubs field and the Password Protect Employee Reports field; also, complete the Password Format field by selecting the desired option to use for passwords with the stubs and reports.

Newsletter Survey

On the topic of increased protection and security: Do you have the Password Policy tab completed in the System File? Do you have multi-factor authentication setup for use with the School Accounting System-Online version, Web Link, and/or K12Docs? Do you password protect Payroll direct deposit stubs and employee reports?

On the topic of increased protection and security: Do you have the Password Policy tab completed in the System File? Do you have multi-factor authentication setup for use with the School Accounting System-Online version, Web Link, and/or K12Docs? Do you password protect Payroll direct deposit stubs and employee reports?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

The Newsletter Survey questions for the September 2024 issue related to deduction/tax adjustments. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

End of Calendar Year Reminders

As the end of calendar year approaches and you begin to prepare 1099s, W2s, and 1095s, keep the following reminders and tips in mind:

Accounts Payable:

- Utilize the Accounts Payable End of Calendar Year Checklist to be sure all steps are completed.

- Nonemployee compensation payments of $600 or more to unincorporated vendors are reported on the 1099-NEC form; and payments for miscellaneous items, including rents, prizes and awards, medical and health care payments, and gross proceeds paid to an attorney, are reported on the 1099-MISC form.

- For 1099s, to print a second name as the “Doing Business As” name for a vendor on a 1099, complete the Additional Recipient Name field and the 1099 Format Name field located on the Miscellaneous tab in the Vendor File.

- Use the Adjust 1099 Amounts option to enter an adjustment for a 1099 amount for a vendor.

- Deliver 1099-NEC and 1099-MISC forms to vendors by January 31, 2025.

- Submit 1099-NEC forms electronically to the IRS by January 31, 2025, and submit 1099-MISC forms electronically to the IRS by March 31, 2025. Reminder, a Transmitter Control Code (TCC) is not needed in order to file 1099s electronically, because the School Accounting System has a direct connection to the IRS’s application to submit the 1099-NEC and 1099-MISC forms.

Payroll:

- Utilize the Payroll End of Calendar Year Checklist to be sure all steps are completed.

- For W2s, define the order items will post and print in Box 14 for employees by using the W2 Box 14 Default Order option. Reminder, only nine items will post to Box 14 for an employee, with only the first four of the posted items actually being printed on the W2.

- Allow time for your employees to review their W2s and 1095s before submitting the returns to the government.

- Deliver W2s to employees by January 31, 2025.

- If applicable, deliver 1095s to employees by March 3, 2025.

- Submit W2s electronically to the Social Security Administration by January 31, 2025.

- If applicable, submit 1095/1094 forms electronically to the IRS by March 31, 2025.

Also, remember that the recordings for the end of calendar year webinars can be requested from the Training Calendar on our website if needed.

Generating 1095s for First Time

If this is your first year generating 1095s in the School Accounting System, follow the items for Step 5 on the Payroll End of Calendar Year Checklist (click here to access). When generating the forms in the School Accounting System, the basic employer and employee information for name, address, and federal ID (social security number) will be populated from the data already entered in the Payroll module. The information to be reported for the offer of coverage in Part II on the 1095-C forms (for large employers) will need to be entered for each applicable employee on the ACA 1095s screen in the Employee File, or by utilizing the Adjust ACA Employee Offer of Coverage option to quickly complete the fields of information for a group of employees. For organizations that are self-insured, the information for covered individuals included on Part III on the 1095-C forms (for large employers) or on Part IV on the 1095-B forms (for small employers) can be imported into the School Accounting System using a file containing the necessary data obtained from your third-party administrator.

Note: If the Affordable Care Act (ACA) Hours Tracking option is setup within the Payroll module, additional reports or options will be available to help you determine if your organization is a large-employer and determine which employees are full-time and need to be included on the 1095 and 1094 forms, but keep in mind, the forms can still be printed without having the option setup. Refer to the FAQ: Do I need to implement the Affordable Care Act (ACA) Hours Tracking option to print the ACA forms? (click here to access) for more information.

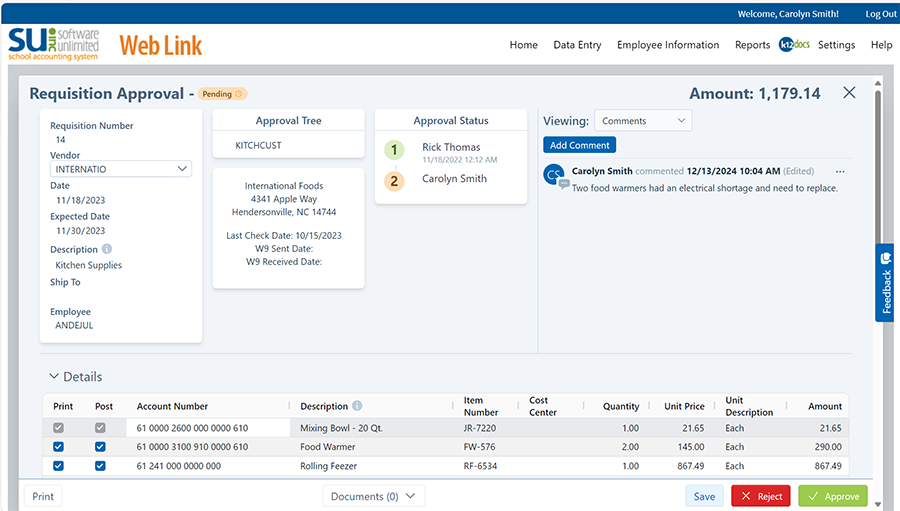

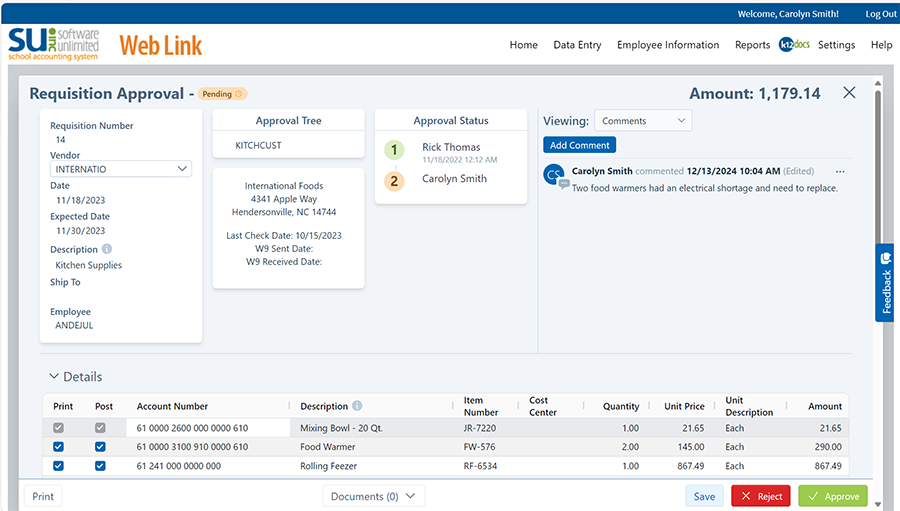

Web Link Upgrade Progress – Beta Testing Continues

In our December 2023 newsletter, we announced the commencement of the development of the next generation of the School Accounting System. We are overhauling the business layer (query logic), which will marry to an all-new, fully browser-based experience. The new web UI (user interface) will offer a modern, intuitive, and responsive user experience, accessible from anywhere, anytime, and on most devices.

Our initial focus is to migrate the current capabilities of the Web Link add-on module, beginning with the Requisitions feature. The beta testing phase has been successful with a group of volunteers, and we’ll be expanding availability to our larger customer base in early 2025.

Additional features of Web Link are completing the development cycle and are in various phases of testing. When those new feature sets are available for release, they will be subsequently included in the beta version of Web Link. Please keep an eye on your inbox in early 2025 for an invitation to try the new interface!

Audits and Electronic Document Management

How much time do you spend preparing and pulling files for your audit? How can you relieve the stress of audits and be sure you are compliant?

An electronic document management solution, like K12Docs, not only allows you to be more organized and audit-ready, but it can also ease the anxiety and save significant time during audits.

During a financial audit, the auditor will typically want to see a variety of supporting documentation – off you go to your paper filing cabinets to hunt and peck, hoping everything was filed properly so you can easily find what you need. After the audit, you lumber back to the file room to return all those documents and folders to the right cabinets. This activity can be overwhelming and time-consuming.

Picture this – what if your auditor can have direct access to all your supporting documentation? Many districts provide auditors with login credentials to the School Accounting System with read-only permission. With the addition of K12Docs, auditors can easily access what they need while you focus on your tasks. It’s a win-win.

Electronic document management is the future, and K12Docs can help your district integrate your documents with the School Accounting System. Visit our website www.k12docs.com for more information and request a personal, online demo to help you determine if K12Docs is a good fit for your organization.

Support Corner - Amy Feit, Director of Customer Support

Optimizing Saving and Printing in SAS-Online

As the majority of our districts have transitioned to the online version of the School Accounting System (SAS), it’s important to note that while the functionality mirrors that of the on-premise version, the processes for saving and printing differ slightly. Here are some tips to enhance your experience with these tasks.

Streamline File Exporting and Saving with Mapped Drives

In the SAS-Online environment, you will see any drive letter designated for your machine under the “Hosted Computer” option. Whether you are saving to your Documents or Desktop folders on a Windows PC, setting up a mapped drive can simplify navigation to these common locations. This setup acts as a shortcut, making your workflow more efficient. For step-by-step guidance on creating a mapped drive, please follow the steps in this Microsoft support link: https://support.microsoft.com/en-us/windows/map-a-network-drive-in-windows-29ce55d1-34e3-a7e2-4801-131475f9557d

Enhance Your Printing Experience

There are many reasons to appreciate our hosted option, including the convenience of having anytime, anywhere access and the peace of mind that your data is safe and secure. We hear from customers who love all the features that come with SAS-Online, but occasionally, they note report printing can sometimes be slower than expected. We have a solution!

To ensure faster and more reliable online printing on a PC, the steps to install and configure the print drivers should be taken as soon as possible. Click the following link for instructions: https://docs.su-inc.com/support/PrintScrewDrivers.pdf. Alternatively, these instructions, along with other important information, can be found in the Resources section of the SAS-Online landing page:

If you are not already taking advantage of the SAS-Online option and would like more information, please contact sales@su-inc.com. If you have any questions on how to install and configure the print drivers on a PC, please contact Customer Support by submitting a support request through the School Accounting System, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

Audit Data Feature

Have you ever needed to know when a record in the School Accounting System was changed and by whom, or when a record was added or deleted? If so, use the Audit Data feature to view record changes, additions, and deletions. The Audit Data feature is accessed by clicking the Audit Data tab within the Activity Log option (located under the Utilities menu on the main School Accounting System screen). When completing the Audit Data feature, the changes can be viewed for a particular date range for selected users. For detailed instructions on using the Audit Data feature, click here to refer to the FAQ for completing the Audit Data tab, or click here to view the Audit Data Tutorial.

Thank you for your feedback!

We understand your time is valuable, and we want to help you save more of it through product and service enhancements. Please keep an eye on your inbox for opportunities to share your feedback, rate how we are doing, and suggest how we can improve.

Your comments and suggestions and crucial for future enhancements. You are truly driving the development of the School Accounting System, and ultimately, saving yourself time by making the system better for you and your colleagues.

As a reminder, we invite you to share product enhancement ideas using the “Program Suggestions” link that is available from any of the main screens in the School Accounting System.

We thank the many of you who have taken the time to share your feedback!

Training Snippets

Each quarter the Training Snippets tutorial covers topics for new options or changes included in recent updates, along with a quick tip for an option or shortcut. The Training Snippets tutorial for December 2024 includes the following topics: updates for End of Calendar Year; changes to 403B reporting for Voya; North Dakota PERS Deferred Compensation Report and North Dakota Public Employees Retirement Report options updates; Illinois Employment Information System updates for Position Codes; Missouri GASB 68 Report option update; and lastly, a reminder of an End of Calendar Year tip in the School Accounting System. Click here (or on the image below) to watch the 3-minute tutorial. To review all the changes and enhancements included in recent updates, click here to view the release notes.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. Where can I search Frequently Asked Questions (FAQs) and Training Tidbits related to topics or options in the School Accounting System? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, In how many states are there school districts using Software Unlimited, Inc.’s School Accounting System? The answer is nine. Congratulations to Cindy Parkhurst from Fremont County School District #6 for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

December 24 (12 to 5 p.m.) and December 25 (all day) for Christmas

January 1 (all day) for New Year’s Day

Staff Spotlight – Kelly Carland

Kelly recently marked her 6th anniversary working for Software Unlimited, Inc. (SUI). Her journey began in the Training Department where she spent many years training and assisting customers in navigating the software. Recently, she transitioned to her current position as a Quality Assurance Analyst, where she specializes in maintaining the highest standards of software quality and user experience. She is passionate about ensuring that our customers receive the best possible experience.

Kelly recently marked her 6th anniversary working for Software Unlimited, Inc. (SUI). Her journey began in the Training Department where she spent many years training and assisting customers in navigating the software. Recently, she transitioned to her current position as a Quality Assurance Analyst, where she specializes in maintaining the highest standards of software quality and user experience. She is passionate about ensuring that our customers receive the best possible experience.

Outside of work, Kelly enjoys spending time with her husband, Paul (also a member of the SUI team), and their two children, Henry and Piper. She stays active coaching their soccer teams and balancing other activities like flag football, baseball, and dance. They enjoy traveling, new experiences, and creating core memories as a family. Recently, they welcomed a new family member, Jasper, a mini aussiedoodle. Wish them luck as they begin the adventure of training him!

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Kristy Hanks who is the Business Manager at Hemingford Public School in Hemingford, NE. We had these questions for her:

How long have you been using the School Accounting System?

• We switched to the School Accounting System in February of 2022. I had used the software for 5 years prior working at another district.

What module do you spend most of your time working in?

• Between Payroll and Accounts Payable, it is a tie.

What is your favorite feature in the School Accounting System?

• I like the Deduction/Tax Adjustments option and how simple an adjustment can be.

What are three words you would use to describe the School Accounting System?

• User-friendly, excellent support, and intuitive.

What is your favorite part of working at your organization?

• I love working with all the people, and we have a great work family! I enjoy helping others.

What are your hobbies?

• Mostly anything to do with spending time with my family and traveling.

If you could meet or interview one person (dead or alive), who would it be, and why?

• My Grandma Jessie, because now that I have more life under my belt, there are things I’d like to ask, such as how were things back in the day, and the stories she could tell.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Don’t get frustrated and don’t be afraid to reach out to support for help!

On the topic of increased protection and security: Do you have the Password Policy tab completed in the System File? Do you have multi-factor authentication setup for use with the School Accounting System-Online version, Web Link, and/or K12Docs? Do you password protect Payroll direct deposit stubs and employee reports?

On the topic of increased protection and security: Do you have the Password Policy tab completed in the System File? Do you have multi-factor authentication setup for use with the School Accounting System-Online version, Web Link, and/or K12Docs? Do you password protect Payroll direct deposit stubs and employee reports?

Kelly recently marked her 6th anniversary working for Software Unlimited, Inc. (SUI). Her journey began in the Training Department where she spent many years training and assisting customers in navigating the software. Recently, she transitioned to her current position as a Quality Assurance Analyst, where she specializes in maintaining the highest standards of software quality and user experience. She is passionate about ensuring that our customers receive the best possible experience.

Kelly recently marked her 6th anniversary working for Software Unlimited, Inc. (SUI). Her journey began in the Training Department where she spent many years training and assisting customers in navigating the software. Recently, she transitioned to her current position as a Quality Assurance Analyst, where she specializes in maintaining the highest standards of software quality and user experience. She is passionate about ensuring that our customers receive the best possible experience.